Inflation in Canada was already at the highest in over 30 years in January, but Russia’s invasion of Ukraine is now putting additional pressure on prices, a Statistics Canada official told a House committee on Friday.

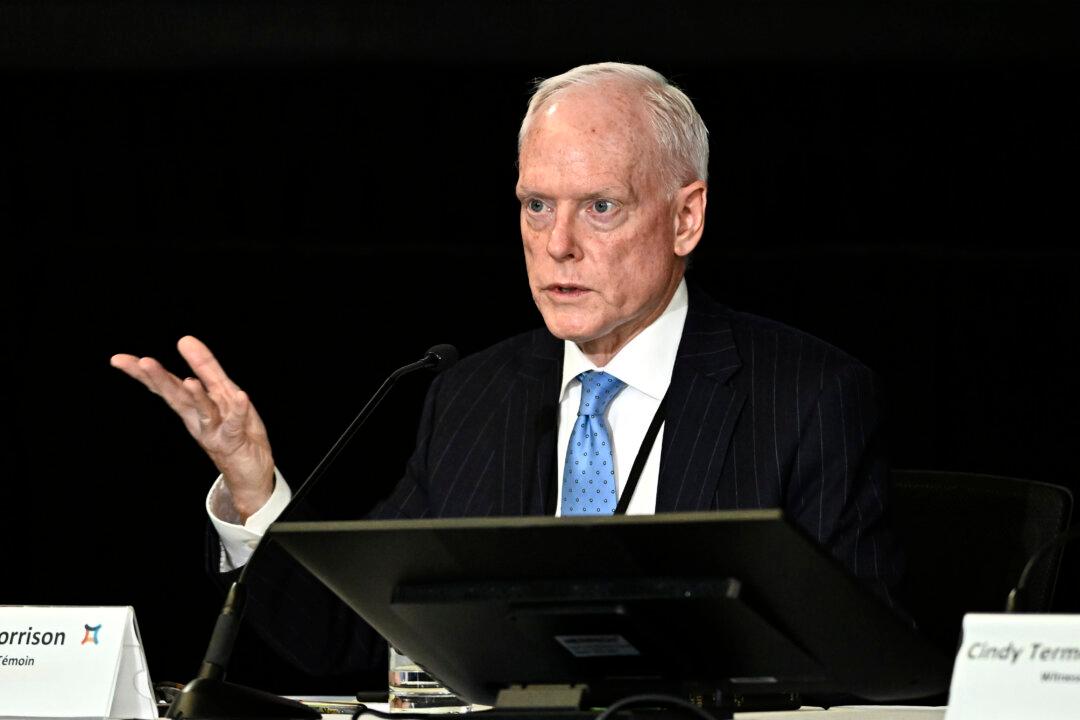

“Looking ahead, the CPI [consumer price index] is likely to remain elevated. Fears surrounding the global oil supplies sent oil prices soaring in early March when Russia’s invasion of Ukraine escalated,” said Greg Peterson, assistant chief statistician at Statistics Canada, as he testified before the Standing Committee on Finance.