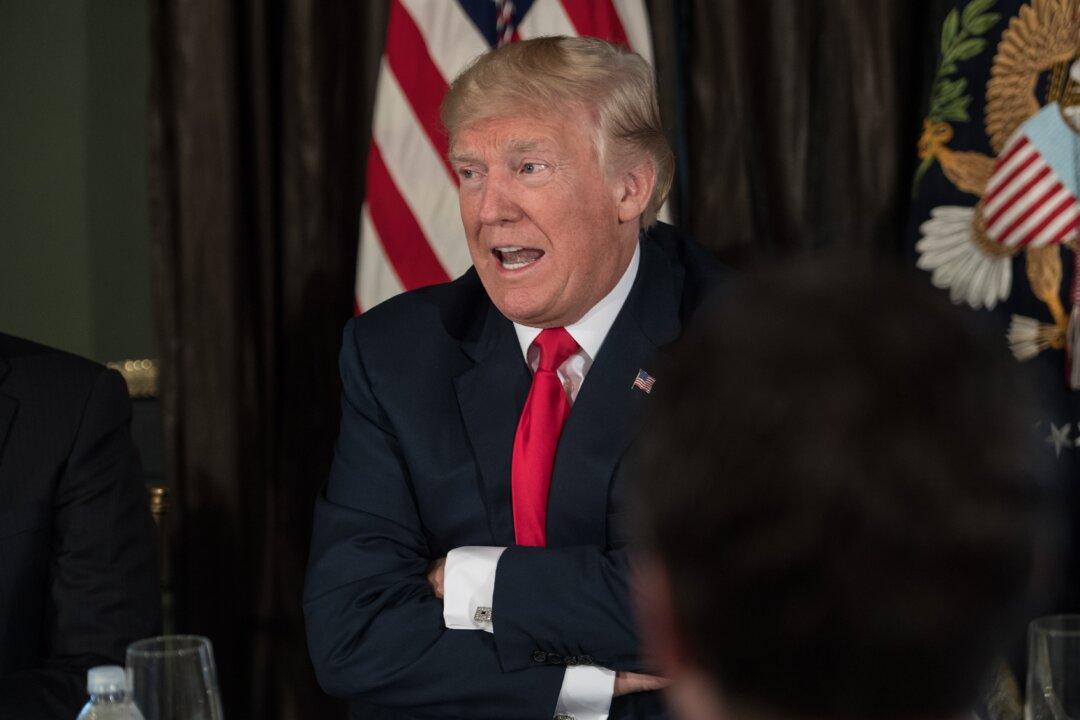

President Donald Trump’s recent executive order suspending payroll tax collection will put extra money in millions of Americans’ pockets without hurting the Social Security program, according to a White House spokesman.

“Providing a payroll tax deferral poses no risk to the Social Security Trust Fund and puts more money in the pockets of hardworking Americans as we fight to end this pandemic from China and rebuild our economy safely,” White House spokesman Judd Deere told The Epoch Times on Aug. 15.