WASHINGTON—U.S. sanctions on Chinese firms that steal U.S. technology are yielding results. State-owned chipmaker Fujian Jinhua is reportedly poised to cease operations as a result of Washington’s penalties for stealing intellectual property (IP).

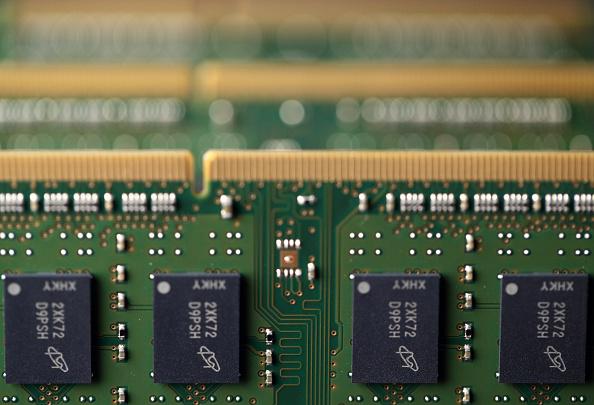

Financial Times reported Jan. 28 that the Chinese company would go out of business by March as a result of the U.S. crackdown. The company was accused of stealing trade secrets from Micron Technology, the largest U.S. memory-chip maker.