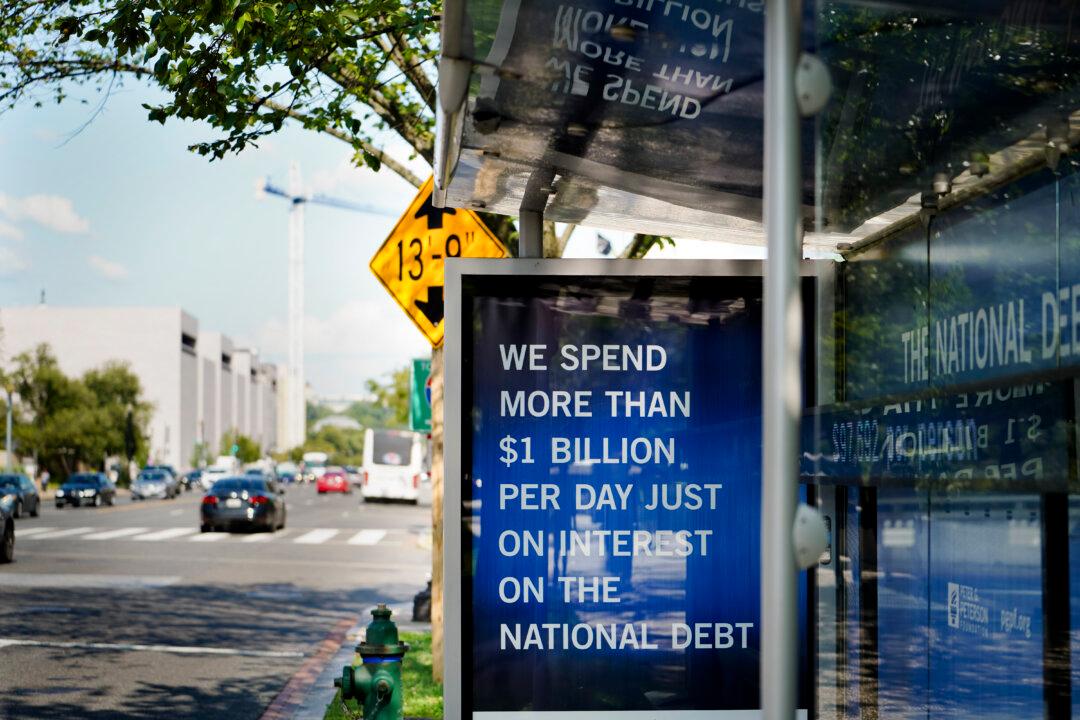

In a historic fiscal milestone for the federal government, the national debt rose to $35 trillion for the first time, according to the latest Treasury Department Debt to the Penny data.

Current debt levels are equal to $105,000 per person and $266,000 per U.S. household.