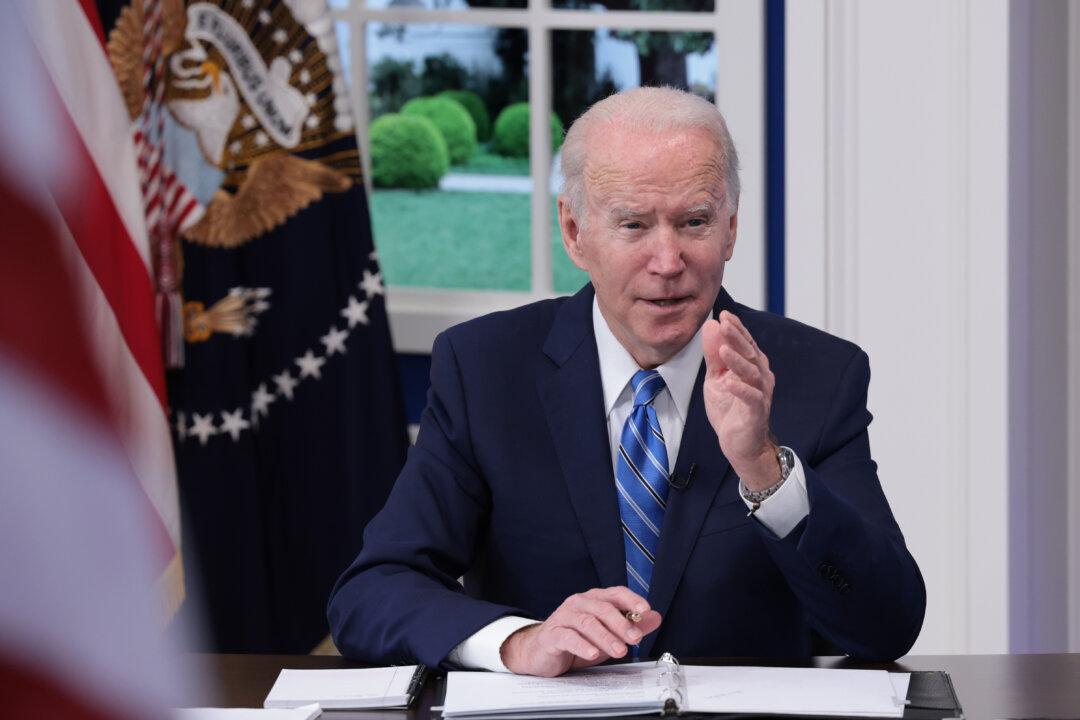

The Biden administration’s plan to address higher meat prices is “misguided,” according to the U.S. Chamber of Commerce.

The White House announced on Jan. 3 its action plan to lower meat and poultry prices, which consists of diversifying and enhancing the meat-producing supply chain by expanding independent processing capacity. One component of the administration’s initiative includes $1 billion for smaller producers that will be allocated from the American Rescue Plan, the coronavirus relief package.