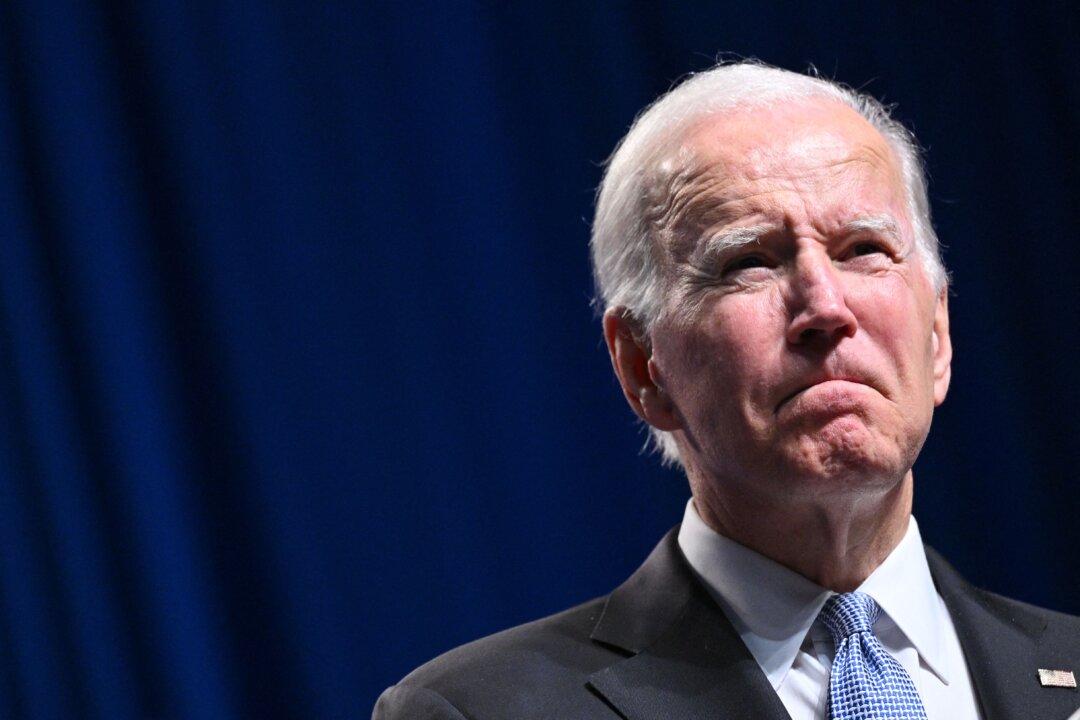

Twitter flagged President Joe Biden’s claim that “55” big corporations nationwide paid no taxes for 2020, as the platform affirmed that “only 14” of them were eligible to be taxed.

Biden took to Twitter to boast about his Inflation Reduction Act last Friday, using one of his favored data targeting big companies. “Let me give you the facts,” the president wrote in an Oct. 28 post. “In 2020, 55 corporations made $40 billion. And they paid zero in federal taxes. My Inflation Reduction Act puts an end to this,” Biden asserted.