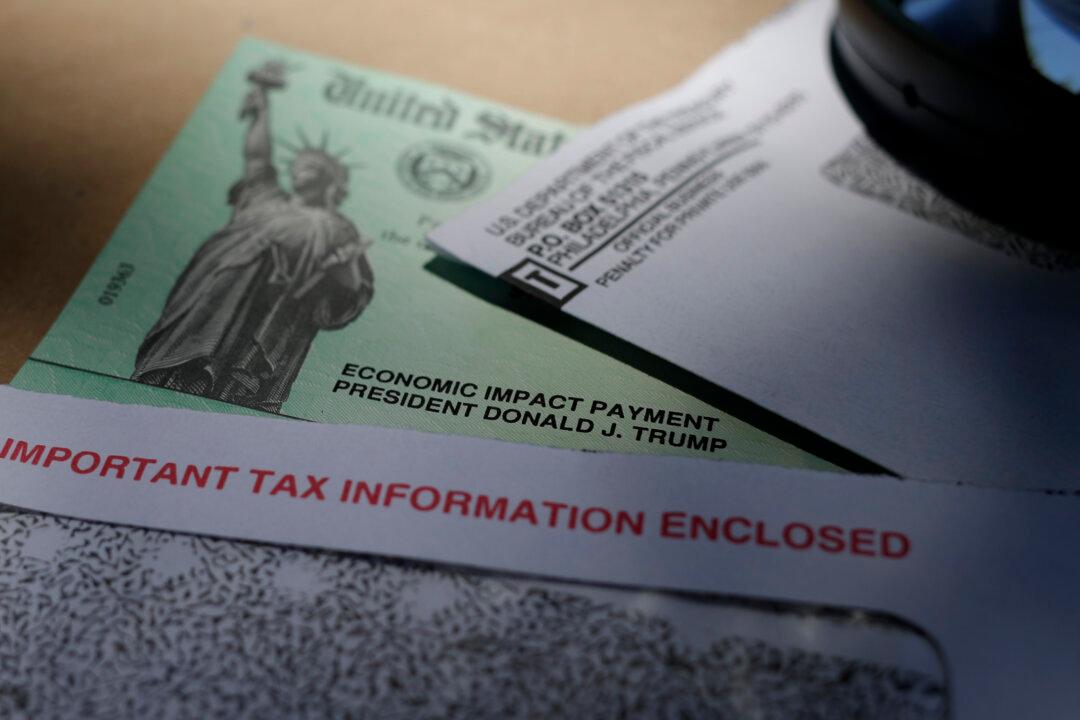

Several U.S. senators are seeking answers from the Social Security Administration (SSA) after the agency sent out repayment requests to recipients who also got COVID-19 stimulus payments.

Over the past week, a number of regional media outlets have published reports citing Social Security recipients saying they received the notices from the agency to repay it.