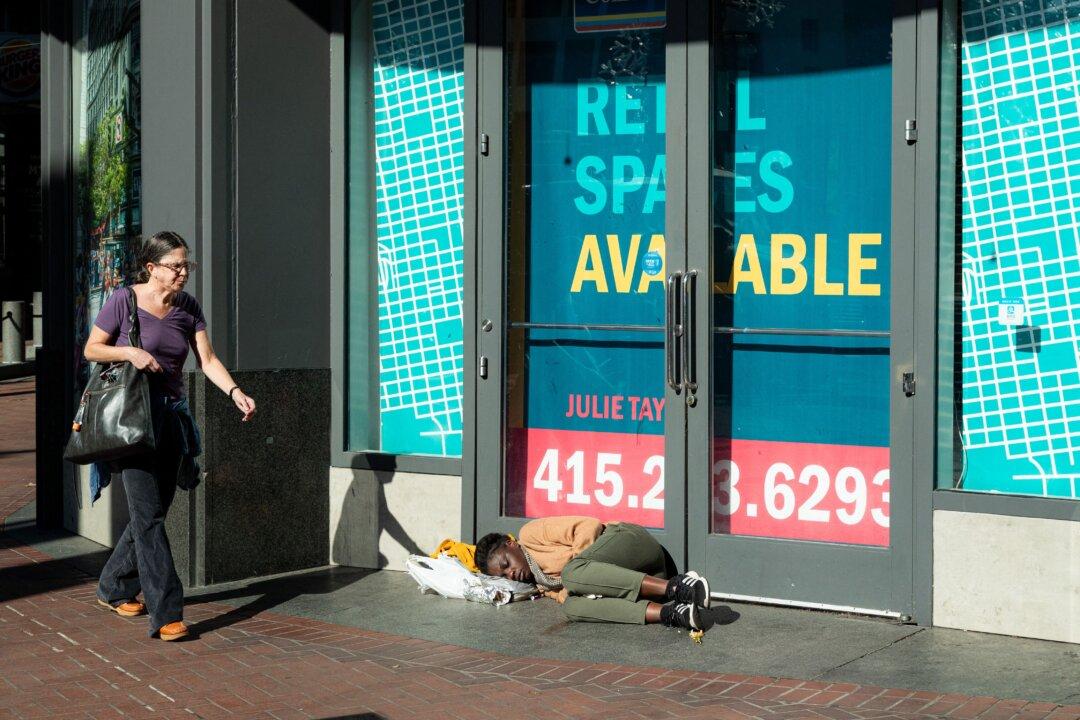

Businesses continued to vacate San Francisco office buildings at an increasing rate through the end of the year, according to preliminary commercial vacancy rate data released by CBRE Group, the world’s largest commercial real estate services and investment firm.

CBRE expects office vacancies in San Francisco will reach a new record of nearly 36 percent by the end of the fourth quarter on Dec. 31—a two-percent increase compared to the third-quarter rate of 34 percent at the end of September.