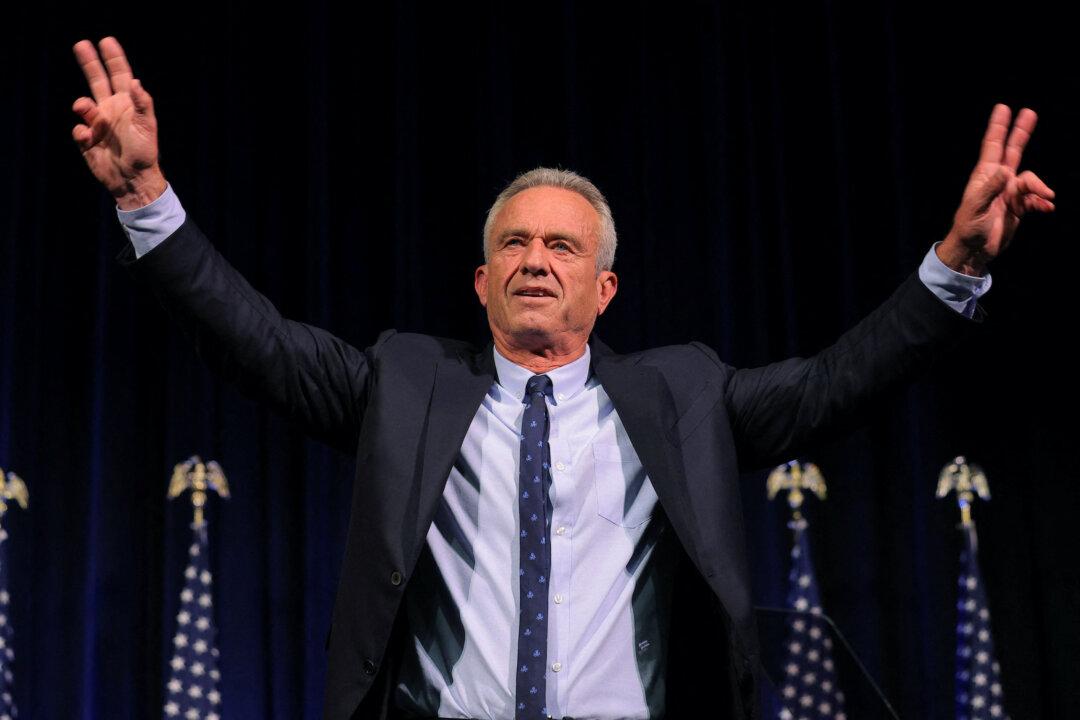

Robert F. Kennedy Jr. said that if elected president, he would create a 3 percent mortgage for Americans guaranteed by the government and funded by the sale of tax-free bonds, and he would work to make it less profitable for large corporations to own single-family homes in the United States.

“If you have a rich uncle who co-signs your mortgage, you will get a lower interest rate because the bank looks at his credit rating. I’m going to give everyone a rich uncle, and his name is Uncle Sam,” Mr. Kennedy said at a recent town hall in Spartanburg, South Carolina.