Federal regulators who fell asleep at the wheel and failed to do their job of preventing distress in the banking system need to be held accountable, lawmakers argued at a Senate hearing.

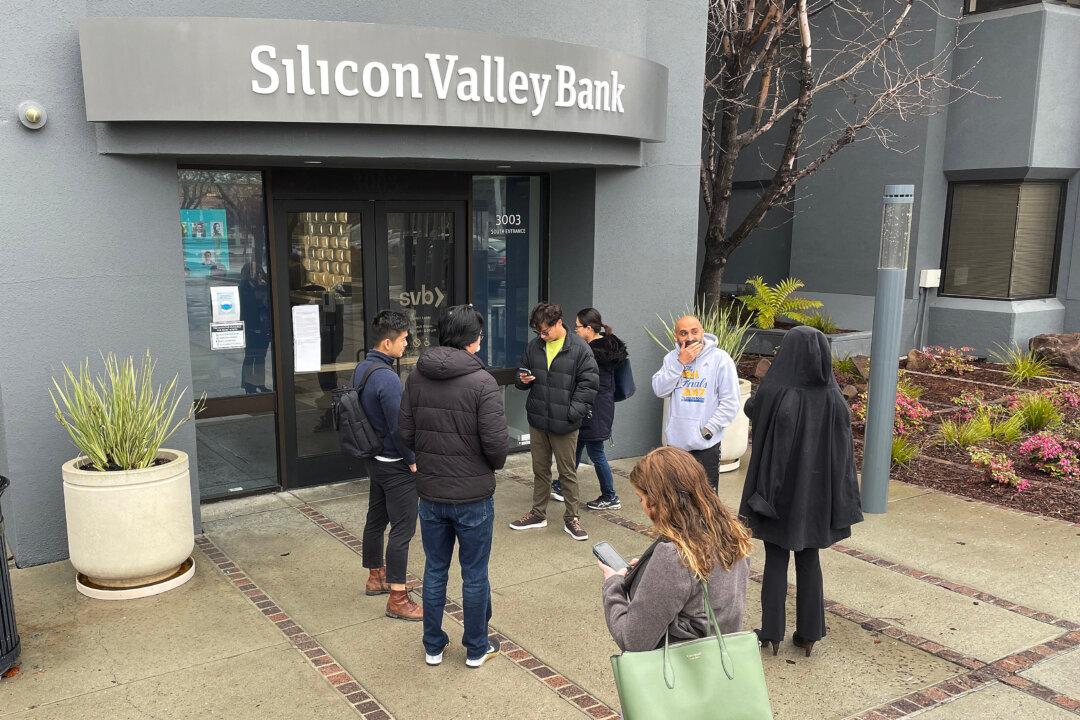

The Senate Banking, Housing, and Urban Affairs Committee held a hearing last week to hold executives accountable after the three bank failures this year.