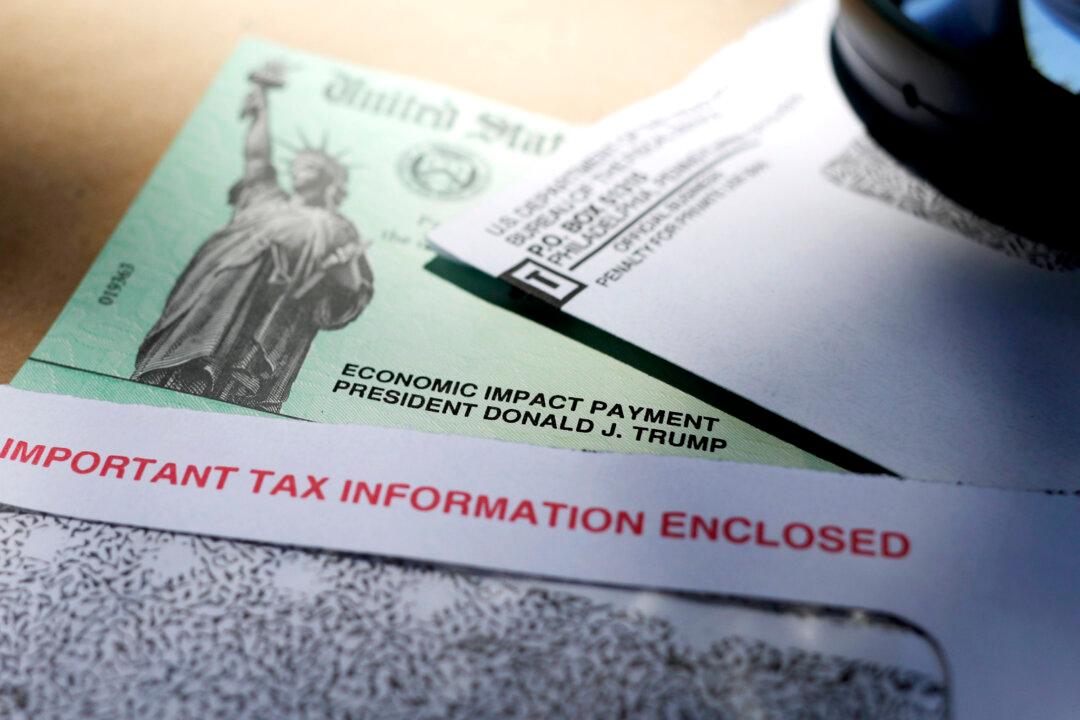

The Senate Finance Committee said that the newly unveiled HEALS Act, proposed by Senate Majority Leader Mitch McConnell (R-Ky.) on Monday, will include direct stimulus payments and checks. Meanwhile, top Democrats including Senate Minority Leader Chuck Schumer (D-N.Y.) rejected much of the bill, ensuring that the payments will not be distributed until August.

However, certain people who may have qualified otherwise will not receive the $1,200 checks, similar to the CARES Act passed in March. Those who have past-due child support payments, prisoners, and people who died prior to Jan. 1 of this year will not receive the payments. The government sent 1.1 million stimulus checks to dead people worth more than $1 billion, according to a watchdog report last month.