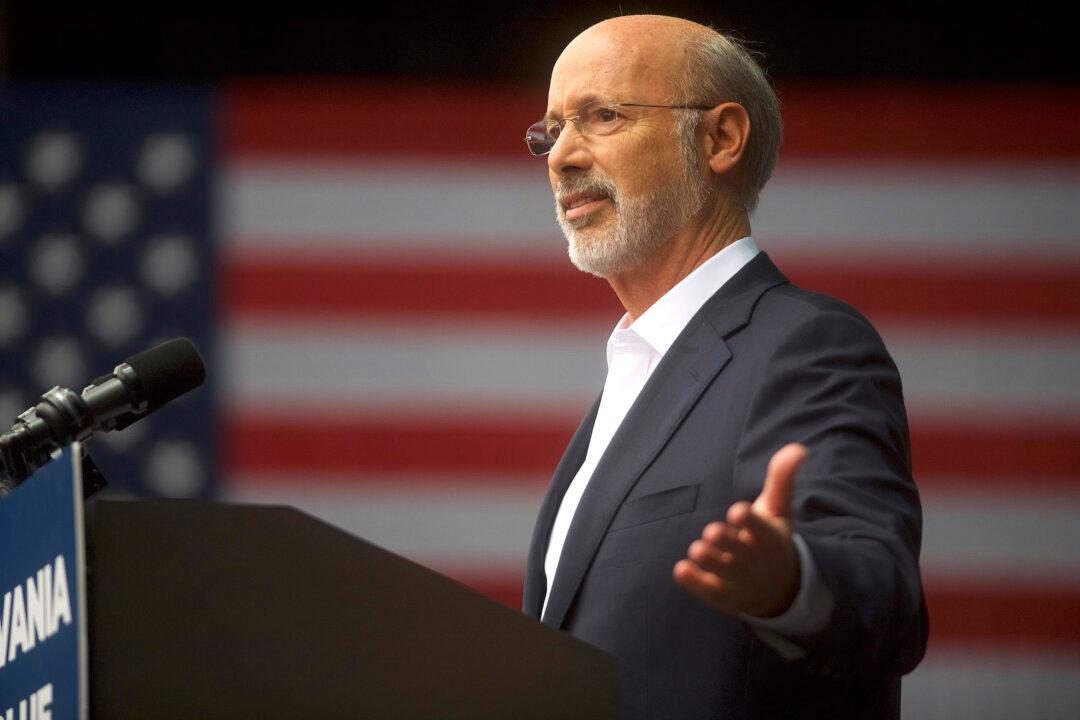

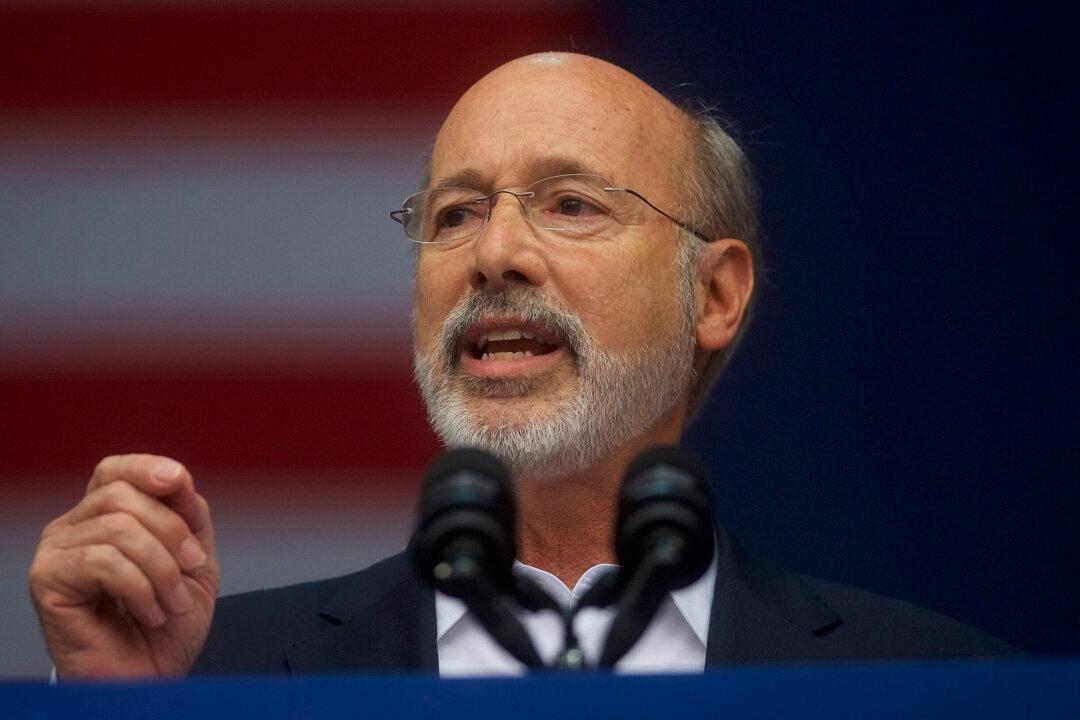

Pennsylvania lawmakers have reloaded legislation from last year that would prohibit the state’s governor from imposing carbon taxes in combination with new climate change regulations without the approval of the General Assembly.

At issue is whether Pennsylvania will join a multi-state climate change compact known as the Regional Greenhouse Gas Initiative, or RGGI.