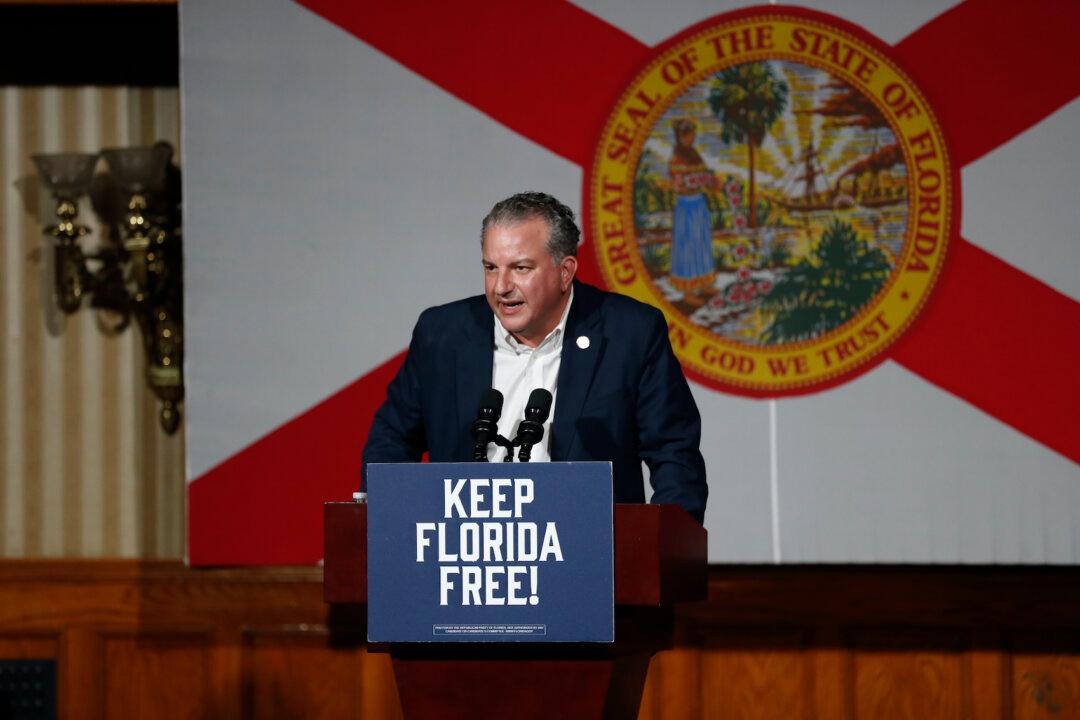

As Florida enters the last two months of the 2023 hurricane season, the state’s Chief Financial Officer Jimmy Patronis has his sights set directly on post-storm fraudsters known as “Storm Chasers.”

“Storm Chasers” are contractors who attempt to siphon as much money from insurance companies as possible by taking advantage of homeowners who have just been hit by a hurricane,” Mr. Patronis told The Epoch Times.