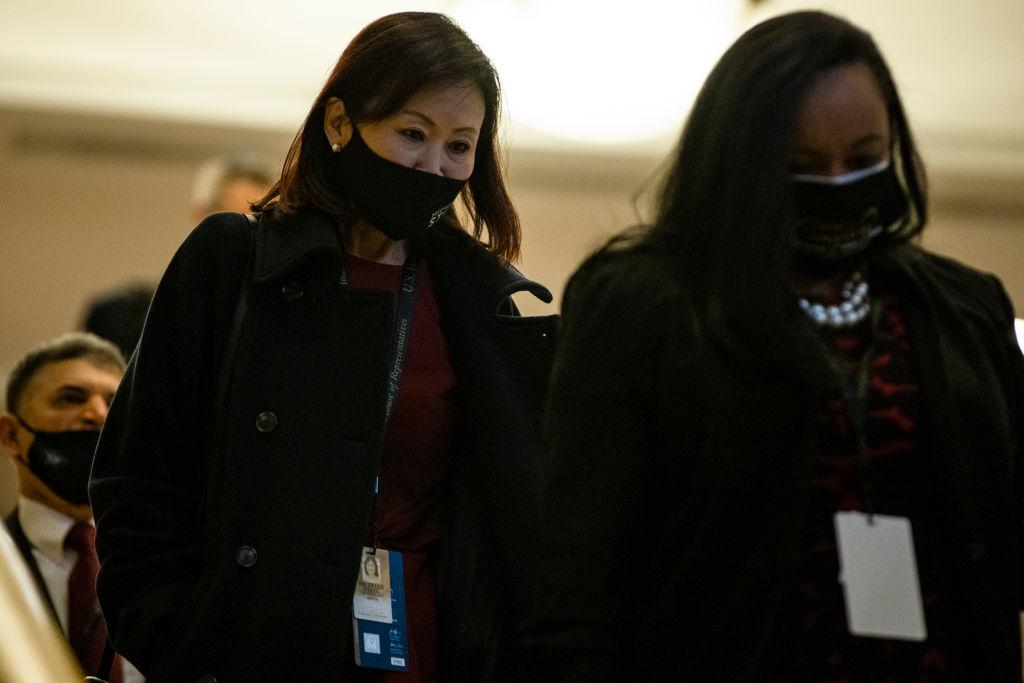

Congresswoman Michelle Steel introduced new legislation March 1 that seeks to incentivize businesses to improve their ventilation systems to reduce the transmission of airborne diseases such as COVID-19.

The legislation, called the Filtering and Retrofitting the Environment for Safe and Healthy Activities Indoors and Revenue (FRESH AIR) for Businesses Act, offers participating businesses the chance to get a tax credit in exchange for modernizing their ventilation systems.