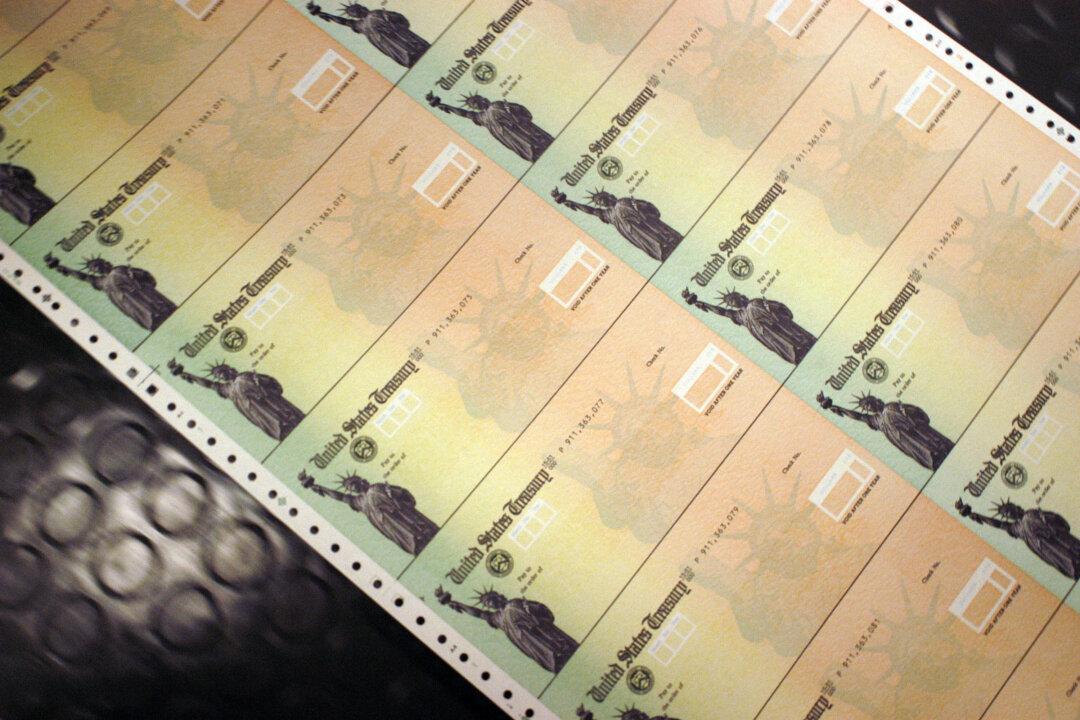

Some Americans will receive one less Social Security payment in June due to how the payments are scheduled.

Generally, the Social Security Administration (SSA) sends out a Supplemental Social Security Income (SSI) payment to people with disabilities and older adults with little or no income on the first of each month.