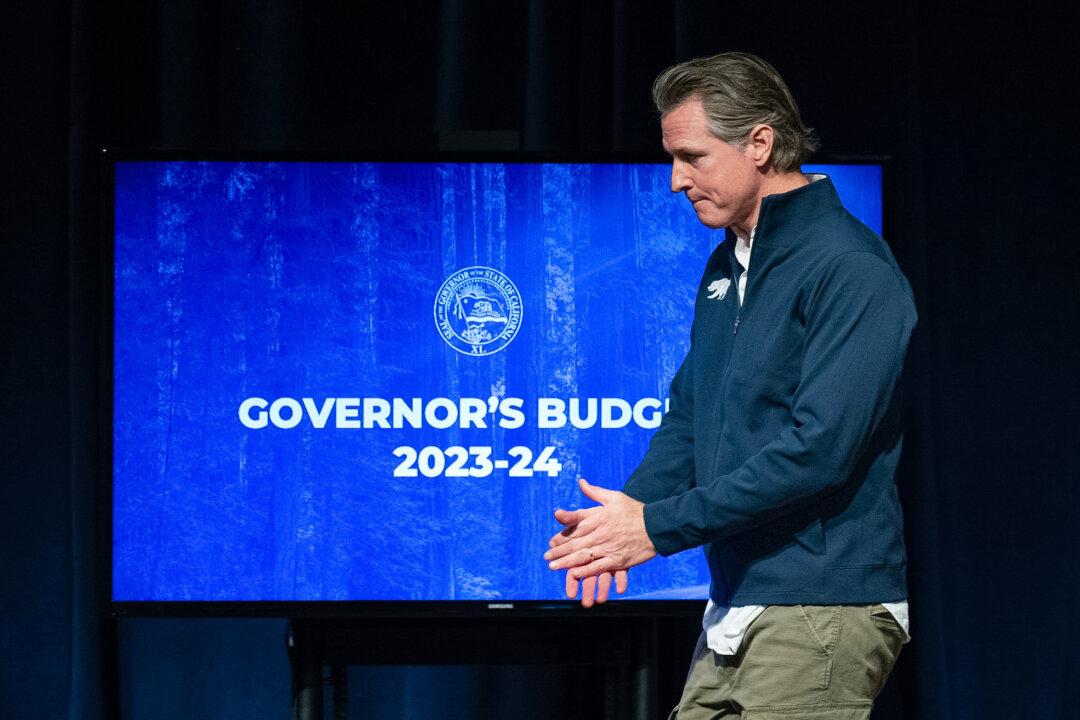

With California facing a record budget deficit, many are looking to Gov. Gavin Newsom’s release of his revised upcoming budget scheduled for May 10 to offer clarity and solutions.

Questions soon to be answered in what is known as the “May Revise” include what spending cuts will be on the table, whether the governor will seek to raise revenues by increasing taxes or calling for bonds, how lawmakers will respond to his updated proposal, and how severe the deficit truly is.