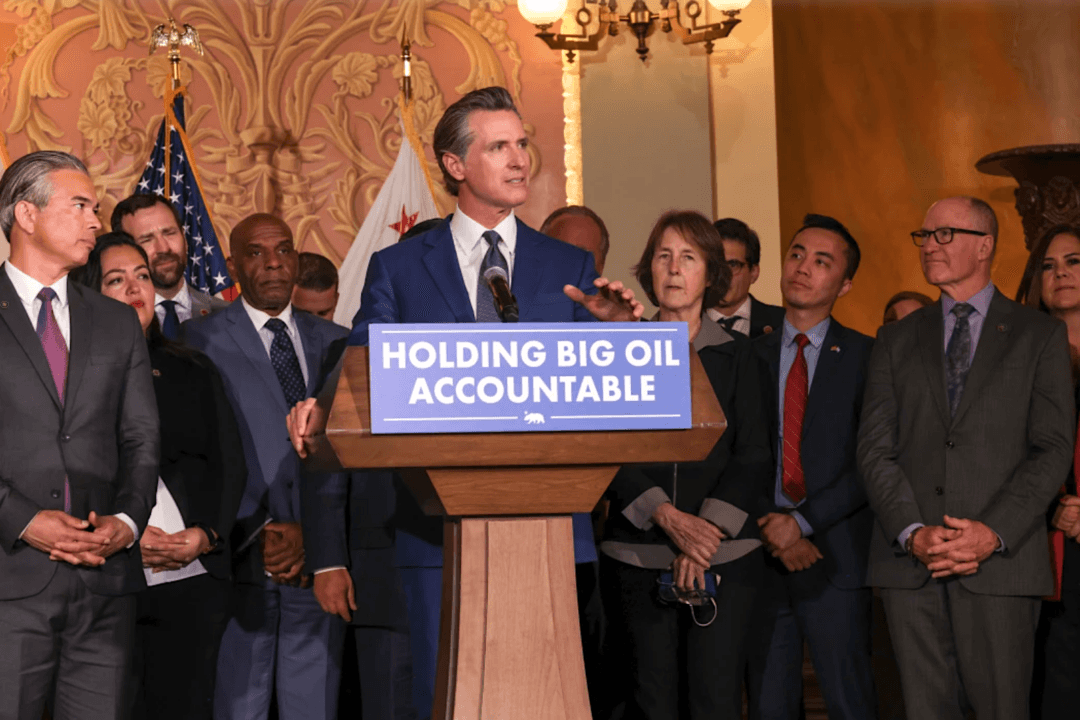

California Gov. Gavin Newsom’s recently passed law to “hold big oil accountable” faces more pushback in the state Legislature as lawmakers decide how to pay for its implementation.

The governor told Californians in a video posted in January that they “won’t pay a cent” for his new law to punish oil companies for last year’s record-high gas prices. However, in his revised budget submitted on May 12, the governor is proposing increasing the state’s electrical energy surcharge—a tax paid by the state’s electricity consumers based on the amount of consumption in California—by $6 million per year to fund the new program.