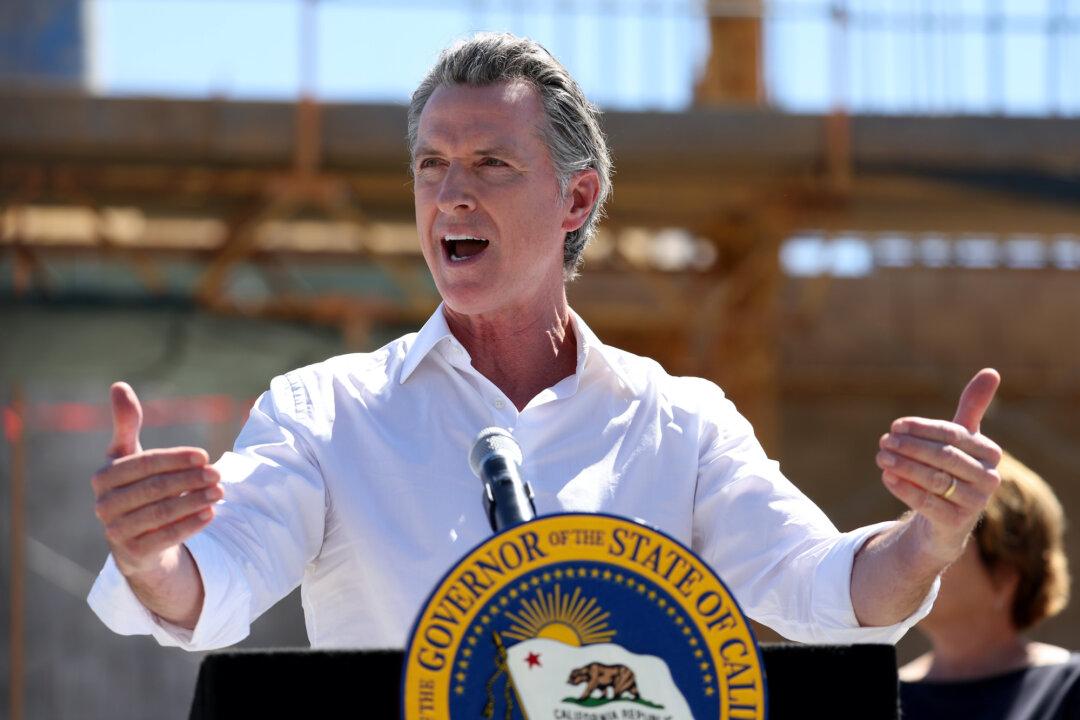

Gov. Gavin Newsom is calling on state lawmakers to impose a new tax on oil companies as gas prices continue to escalate in California, but industry experts say the tax would add more cost for consumers and could destabilize oil businesses.

Prices at the pump in the Golden State are the highest in the nation, climbing again this week to an average of $6.41 per gallon Oct. 4, according to the Automobile Club of Southern California.