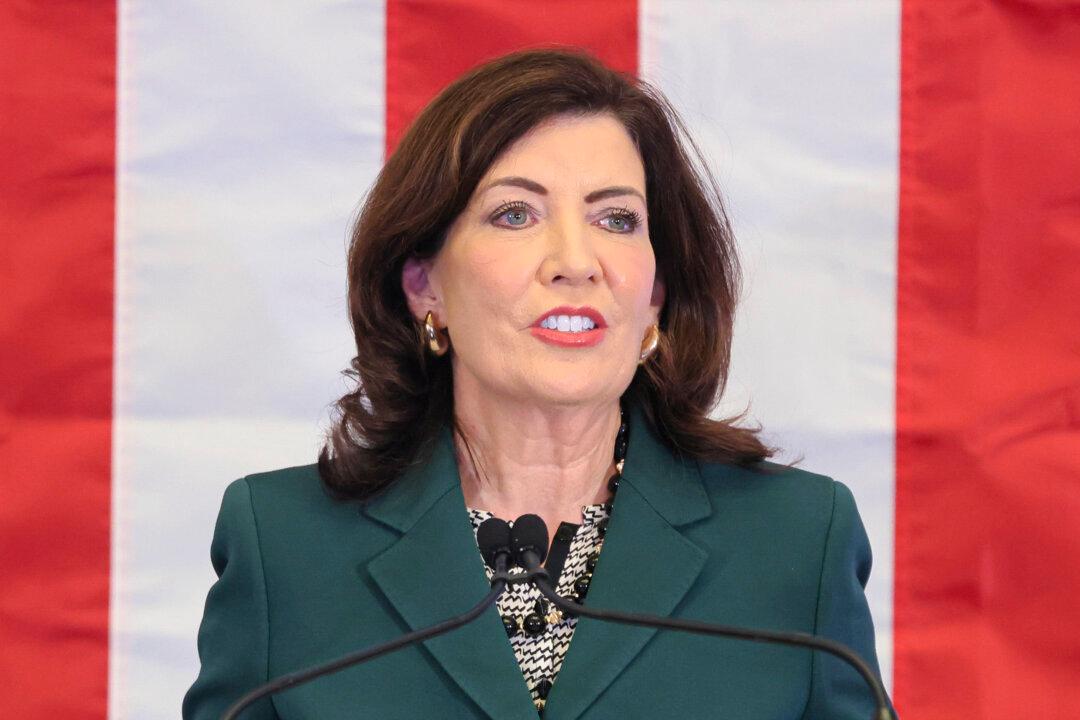

Many parents in New York will see checks arrive from the state over the next weeks, Governor Kathy Hochul said.

The payments come as a one-time supplement to the tax benefits provided by the Empire State Child Credit, a program meant to help New Yorkers pay for child care.