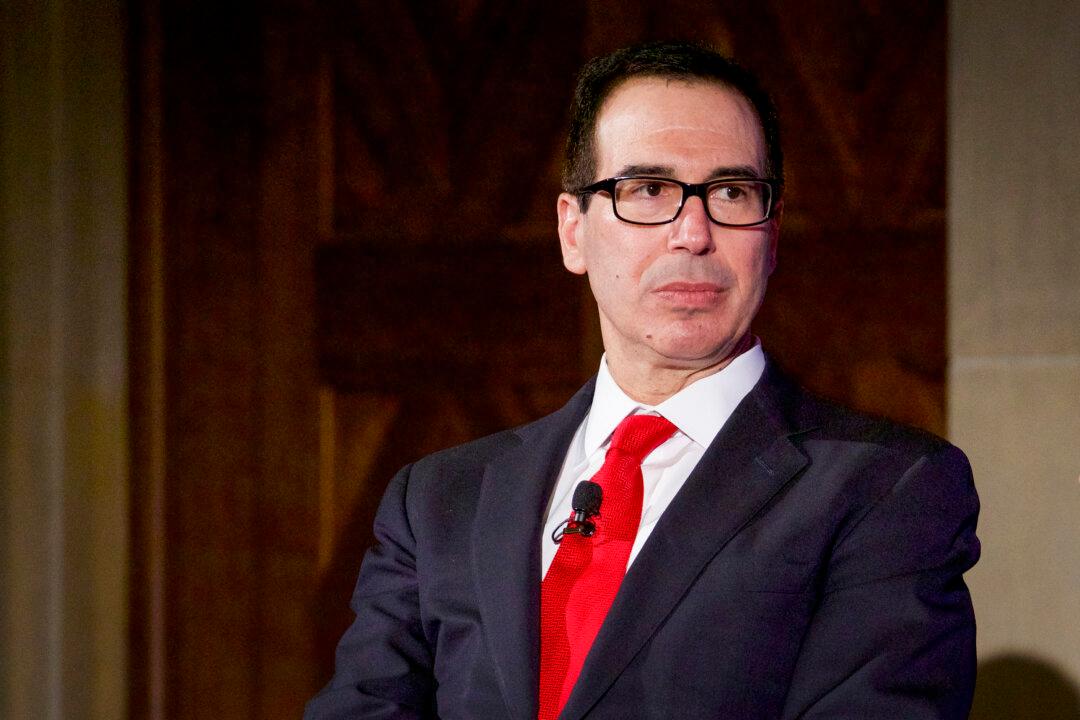

Treasury Secretary Steven Mnuchin said on Monday he would talk to Congress about oversight of the government’s $660 billion small business relief Paycheck Protection Program (PPP), after earlier resisting calls to disclose the names of recipients and loan amounts.

Mnuchin wrote in a tweet he would engage with lawmakers “on a bipartisan basis” to discuss oversight arrangements that would balance disclosure with “appropriate protection of small business information.”