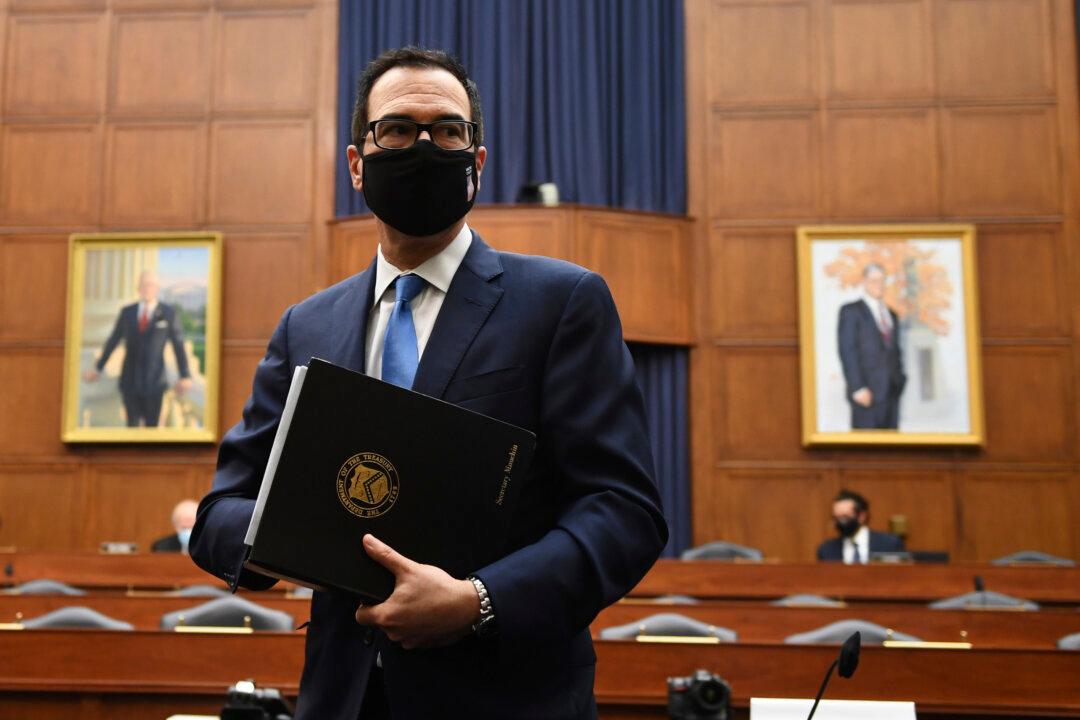

WASHINGTON—Treasury Secretary Steven Mnuchin urged Congress to quickly enact a new pandemic relief package that focuses on hardest-hit swaths of the economy, as lawmakers race to stand up federal aid in the face of the latest spike in coronavirus cases across much of the Sun Belt and persistent severe unemployment.

Deadlines loom as the extra $600 weekly benefits provided by the federal government to tens of millions of unemployed workers are set to expire July 31. Mnuchin, the Trump administration’s chief negotiator on economic relief, told a House hearing on July 17 that Congress should pass a new rescue package by the end of the month.