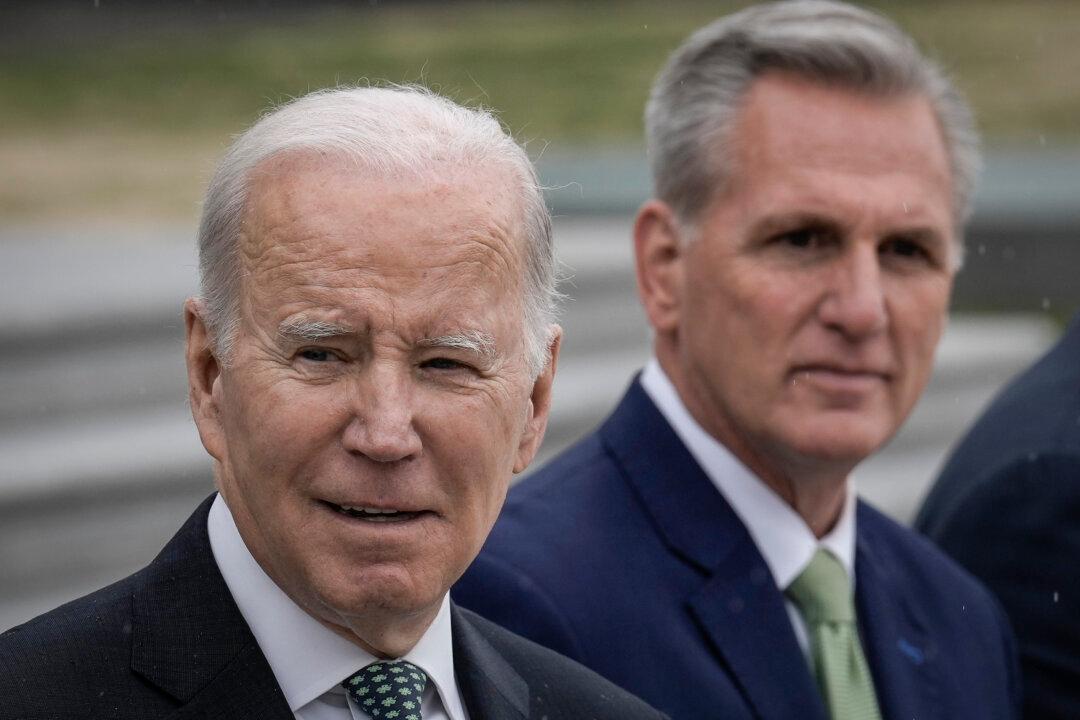

A meeting between President Joe Biden and top congressional leaders that had been scheduled for May 12 to discuss the debt ceiling has been pushed back until next week, according to the White House.

The leaders were scheduled to meet to discuss lifting the debt ceiling in order to avoid a default on the country’s debt obligations before the June 1 deadline.