A class action lawsuit filed against the California FAIR Plan Association claims the plan—which provides basic coverage when other insurers aren’t available but charges a higher premium for it—sold policies lacking adequate coverage for fire and smoke damage.

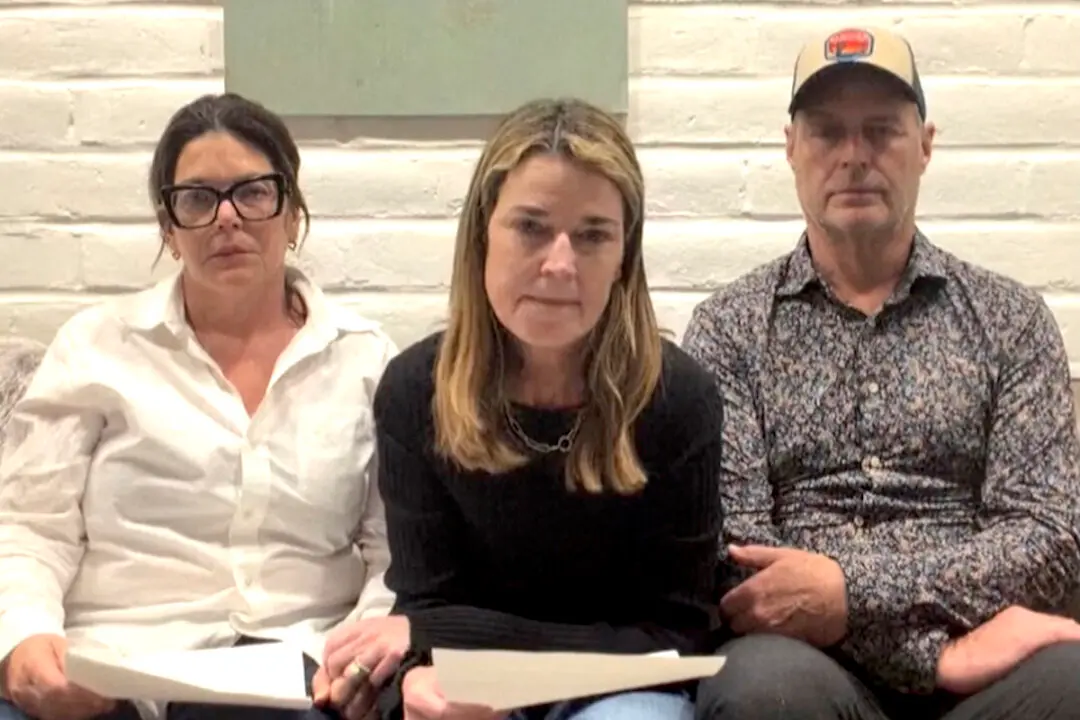

Under the lawsuit, filed in Alameda County Superior Court on July 24, four California residents on behalf of 365,000 FAIR Plan policyholders are asking the association to increase its fire coverage for all customers to comply with state law.