The IRS’s handling of a COVID-era tax credit ranks as the agency’s most serious problem, hurting “countless eligible businesses,” a government watchdog says.

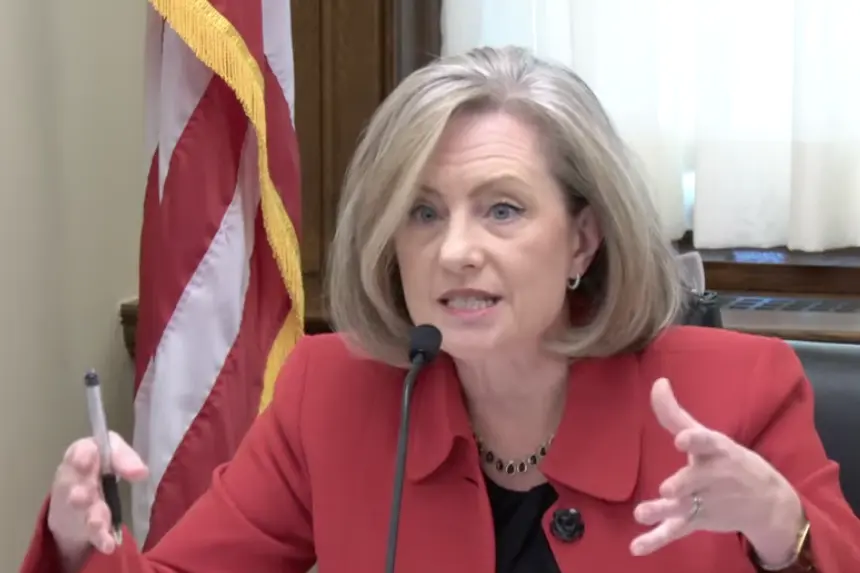

Missteps have plagued the Employee Retention Credit program, a report from Erin Collins, the national taxpayer advocate, said. The tax credit compensates employers who kept people on their payrolls despite negative effects from pandemic mandates during 2020–21.