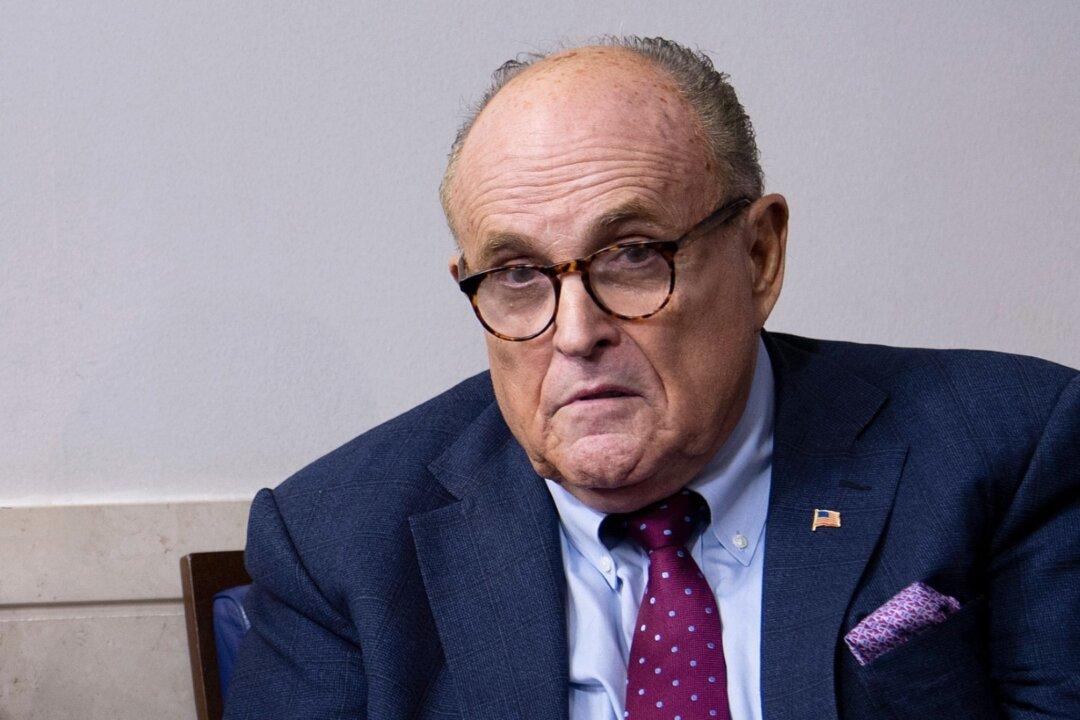

The Internal Revenue Service (IRS) has placed a tax lien of nearly half a million dollars on a Florida condo owned by former New York City mayor Rudy Giuliani, court filings show.

The document—a notice of federal tax lien—surfaced just recently, though it was entered into record at the County Courthouse, Palm Beach County, in West Palm Beach, Florida, on Sept. 1, 2023.