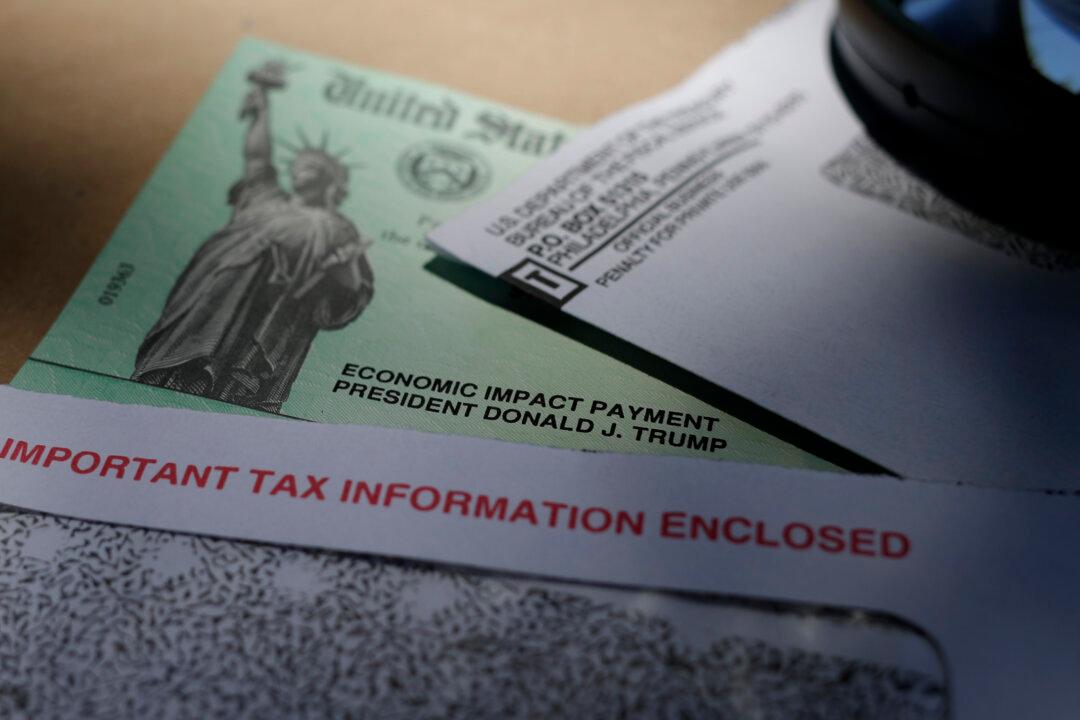

The IRS finally has issued guidance about how to handle state stimulus payments, which comes about a week after it issued an alert advising millions of taxpayers to delay filing tax returns until it provided “additional clarification” about the payments’ taxability.

In a statement issued late on Feb. 10, the IRS stated that most relief checks issued by states last year aren’t subject to federal taxes.