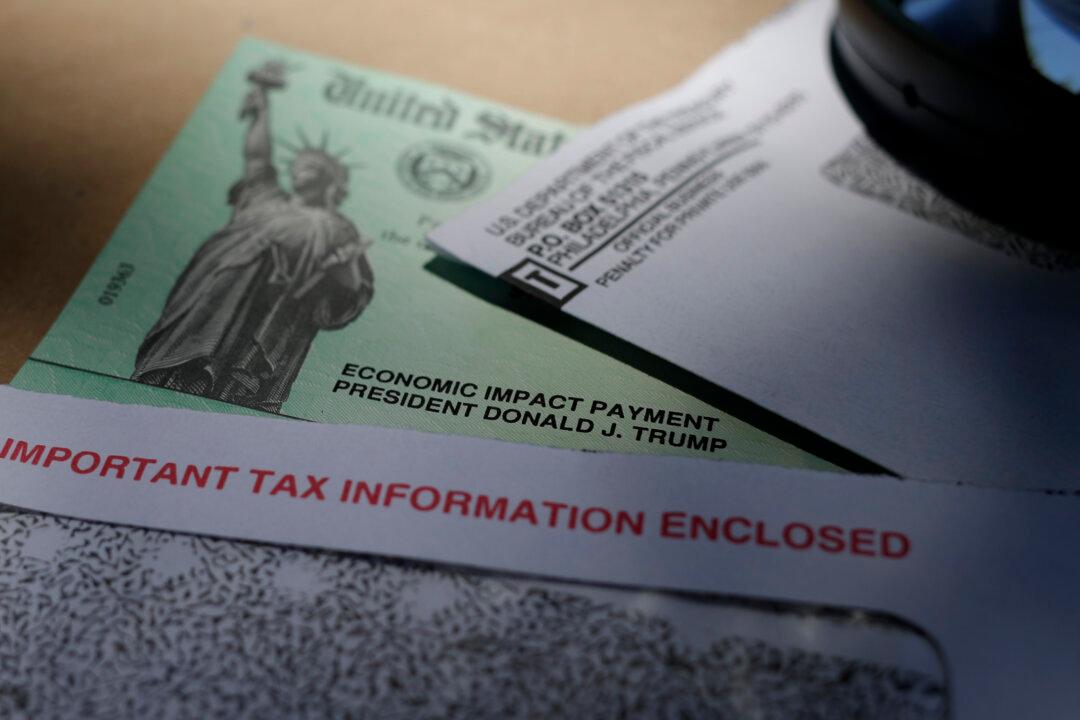

The deadline for Americans to claim a COVID-19 pandemic-era stimulus payment worth $1,400 is Tuesday, the Internal Revenue Service has said.

April 15 marks Tax Day along with the three-year deadline to claim the 2021 tax credits and refunds, including the $1,400 stimulus payment that was sent out to millions of Americans. Some Americans still have not received or filed for that payment.