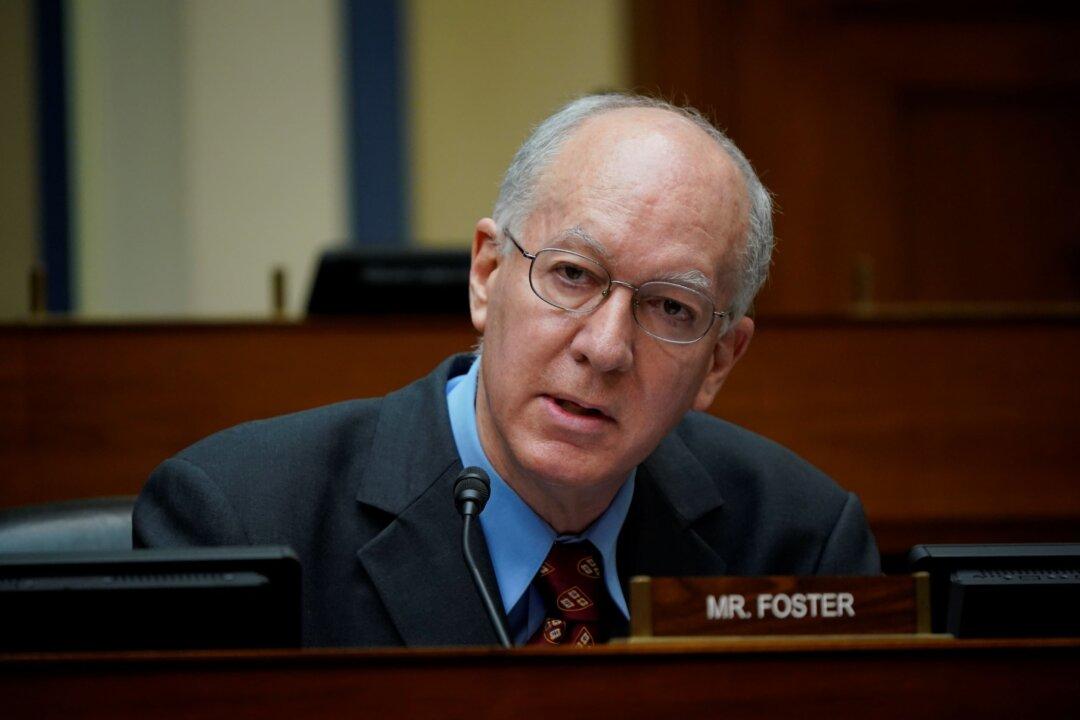

Members of Illinois’ Congressional delegation are weighing in on the $3.5 trillion spending plan the U.S. House allowed to proceed Tuesday.

The Democrats’ resolution, passed along party lines, could mean a major expansion of benefits.

Members of Illinois’ Congressional delegation are weighing in on the $3.5 trillion spending plan the U.S. House allowed to proceed Tuesday.

The Democrats’ resolution, passed along party lines, could mean a major expansion of benefits.