All Republicans on the House Judiciary Committee on April 22 ordered Twitter board members to preserve all records regarding Elon Musk’s effort to buy the technology company.

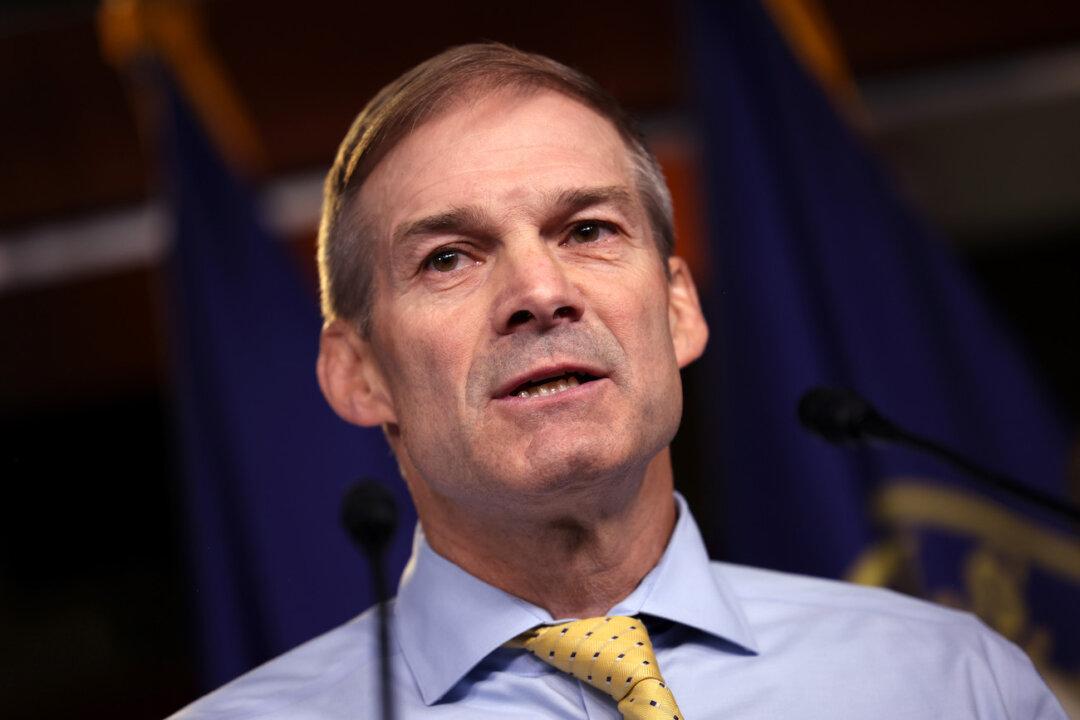

“As Congress continues to examine Big Tech and how to best protect Americans’ free speech rights, this letter serves as a formal request that you preserve all records and materials relating to Musk’s offer to purchase Twitter, including Twitter’s consideration and response to this offer, and Twitter’s evaluation of its shareholder interests with respect to Musk’s offer,” Ranking Member Jim Jordan (R-Ohio) and the other Republicans told board members in the letters.