Republicans on the House Oversight Committee’s Subcommittee launched a new probe into the Federal Deposit Insurance Corporation (FDIC) on Monday to investigate the allegations of sexual harrasment within the agency.

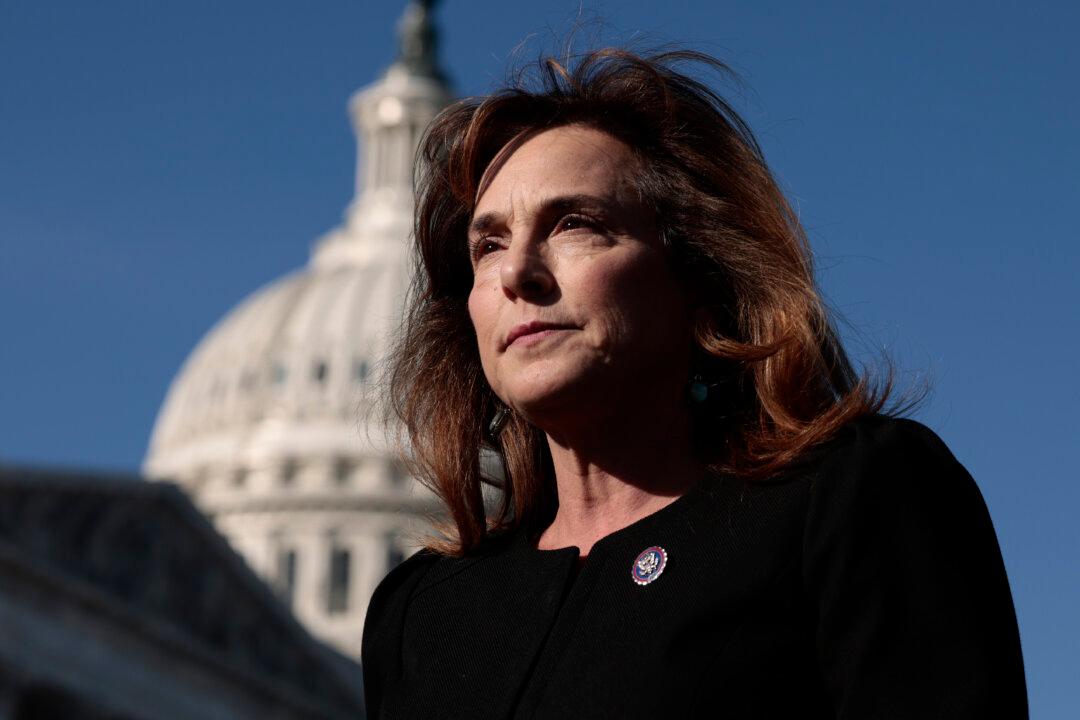

Subcommittee on Health Care and Financial Services Chairwoman Lisa McClain (R-Mich.) and Rep. Andy Biggs (R-Ariz.) sent a letter to FDIC Chairman Martin Gruenberg on Monday, calling on him to turn over records of sexual harassment complaints within the agency and the official record of the responses those complaints received. The Republican lawmakers further called for internal communications about these complaints shared by the FDIC’s human resources department and by employees in the chairman’s office.