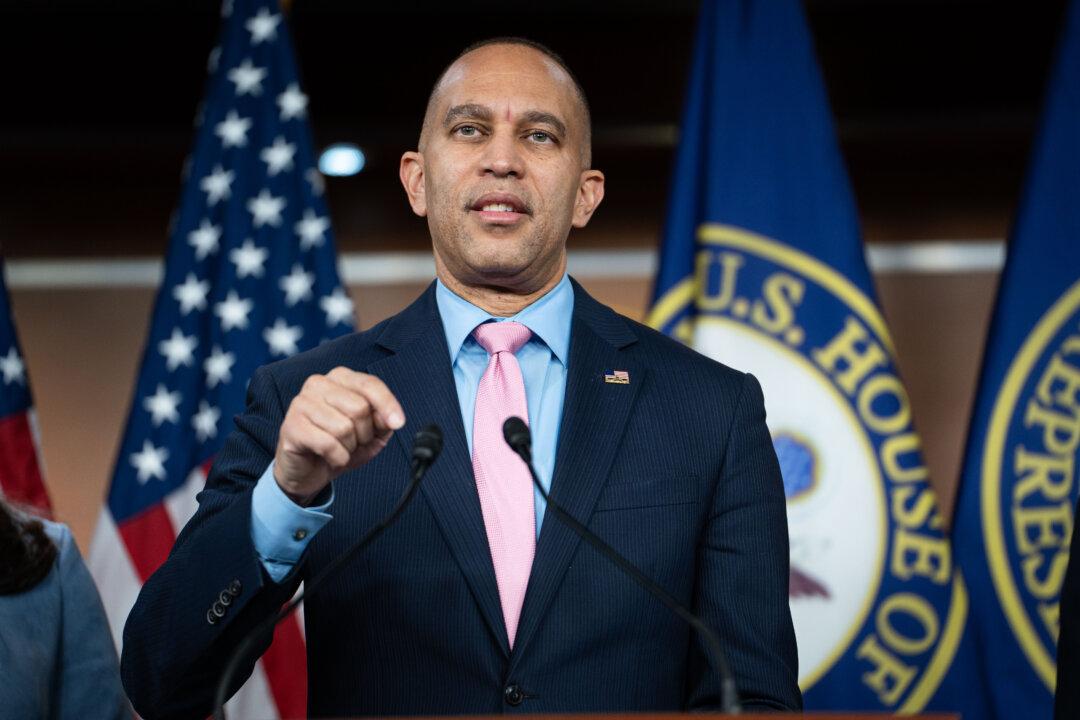

LEESBURG, Va.—Four months after the November 2024 election, House Democrats have gathered at an issues retreat outside Washington. Not long into the second Trump presidency, they’re seeking to define a response to him and Republicans more broadly.

One big theme of that response emerged early on the first day.