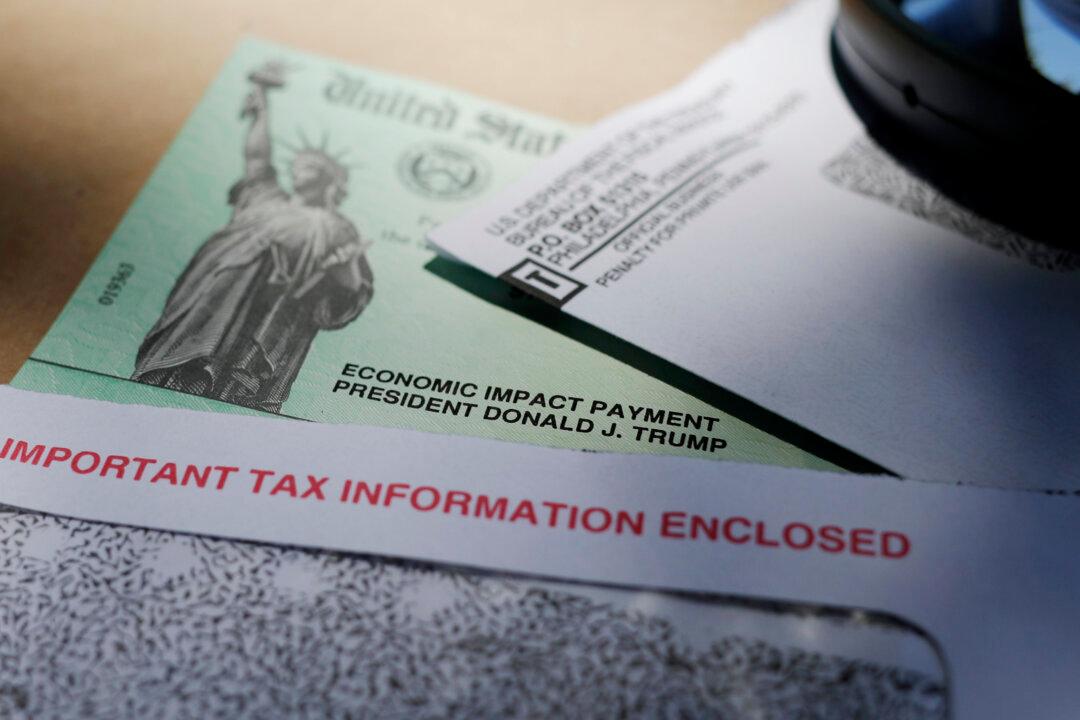

Congress on Monday night passed a $900 billion CCP virus stimulus package that included $600 stimulus payments for certain individuals.

The $600 per person, which is half the $1,200 that was directed to most adults in March, should be distributed to bank accounts next week, said Treasury Secretary Steven Mnuchin in a televised interview on Monday. In March, when the CARES Act was passed, it took just over two weeks for the Internal Revenue Service (IRS) to distribute the initial payments to people.