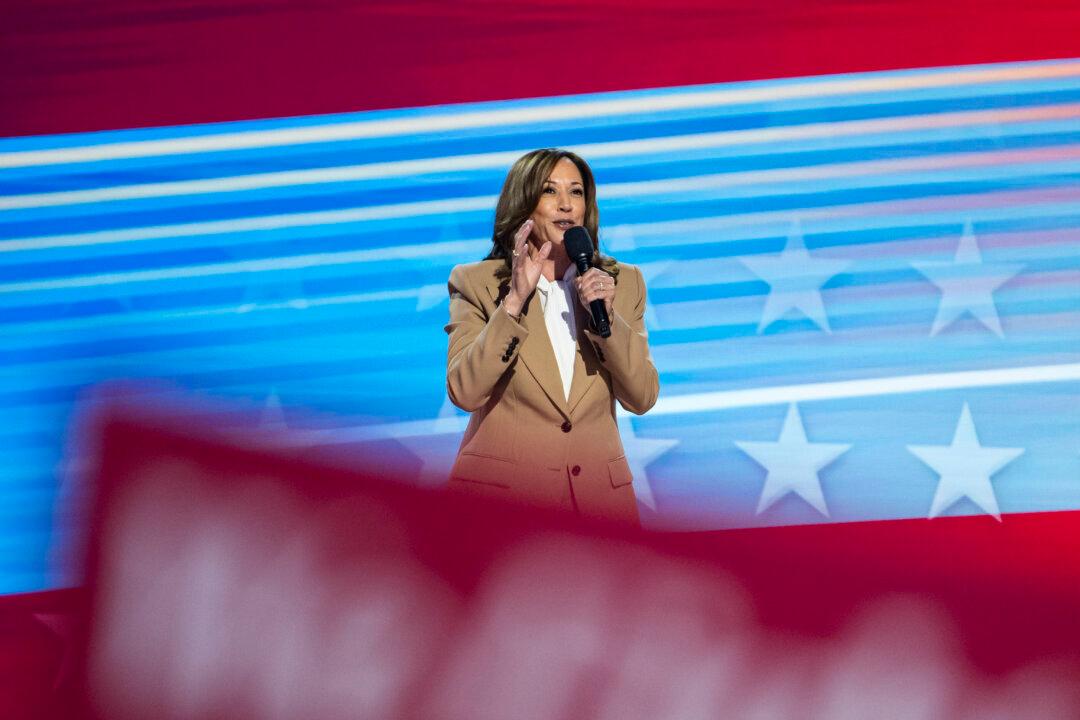

Democratic Presidential candidate Kamala Harris is proposing to increase the corporate tax rate as part of her economic agenda if she wins the presidency in November.

Harris campaign spokesperson James Singer confirmed in a statement on Aug. 19 that Harris is backing an increase in the corporate tax rate from 21 percent, to 28 percent, the same policy put forward by President Joe Biden in his administration’s fiscal year 2025 budget. Changes to the U.S. tax code require approval by Congress before they can be enacted.