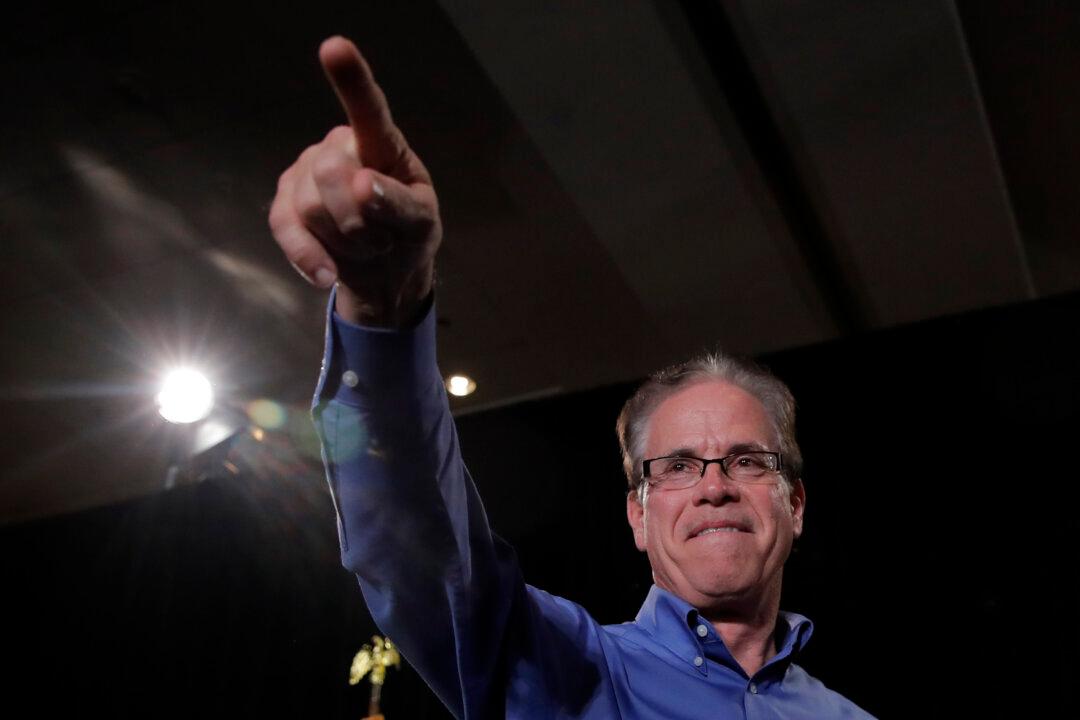

WASHINGTON—Republican Sens. Mike Braun and Todd Young of Indiana are both in their first terms as members of the U.S. Senate, while Rep. Kevin Brady (R-Texas) first came to the House of Representatives in 1997.

Two Indiana rookies and a grizzled Lone Star State veteran may seem like an unlikely team, but the trio thinks they have the solution to the relentless federal spending, deficit, and national debt problems their party has promised for decades to fix.