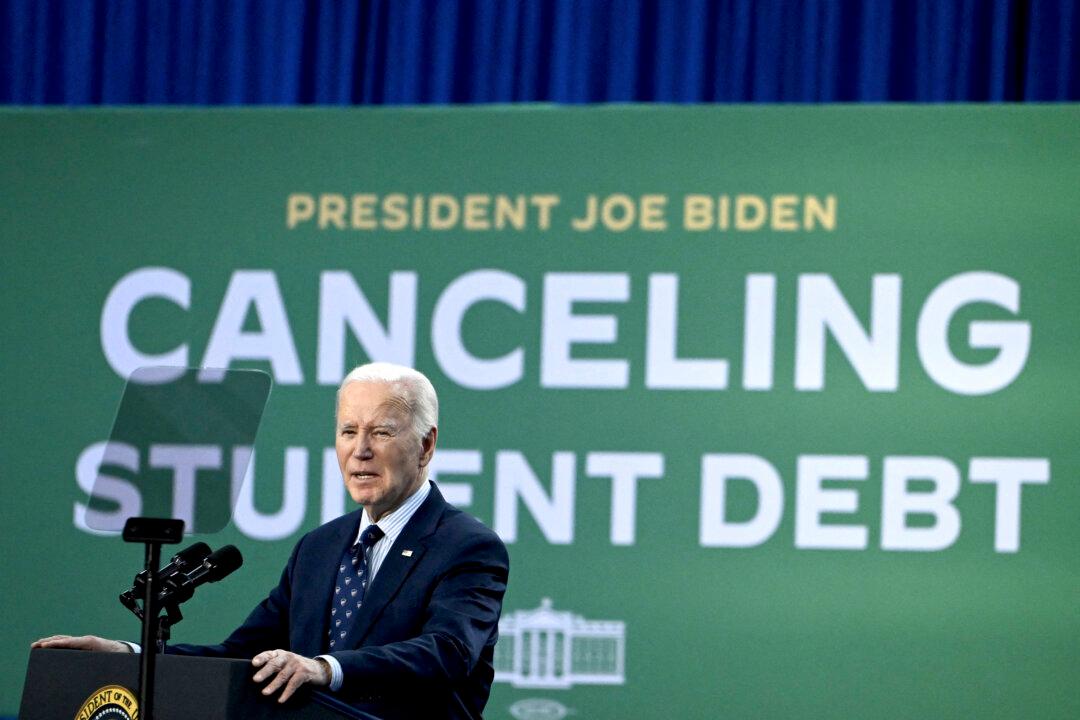

In the final days of his term, President Joe Biden announced the cancellation of federal student loan debt for more than 150,000 more borrowers.

The latest round of relief provides $1.26 billion for 85,000 individuals who attended schools that allegedly “cheated and defrauded their students;” $2.5 billion for 61,000 borrowers with total and permanent disabilities; and $465 million for 6,100 public service workers, the U.S. Department of Education said on Monday.