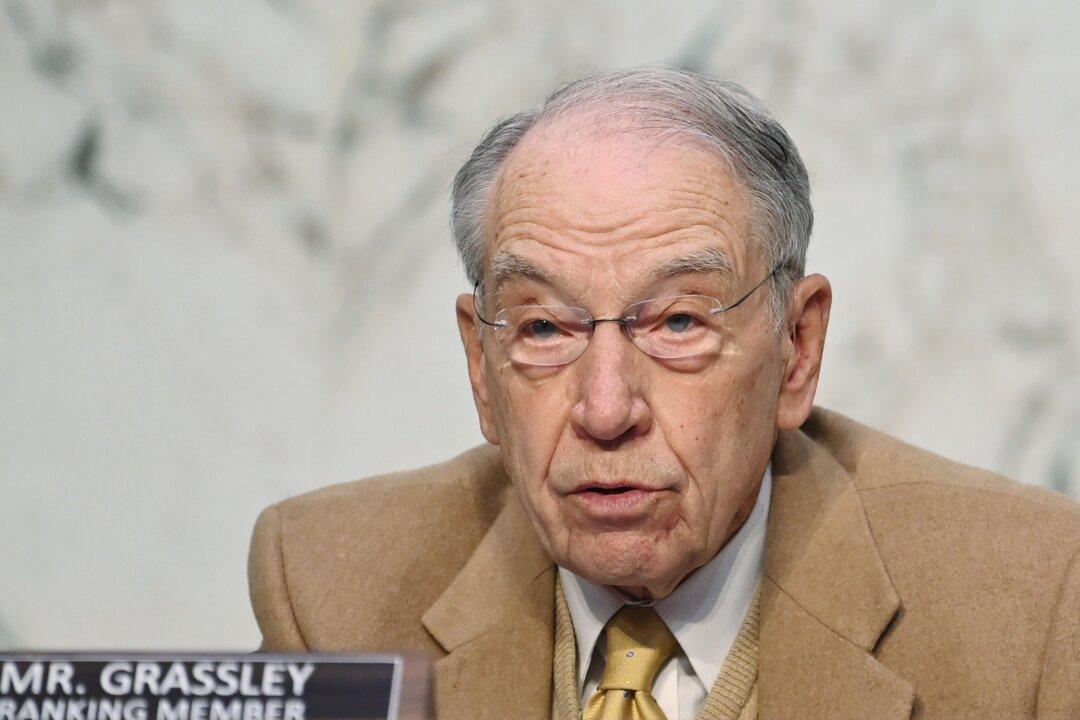

Sen. Chuck Grassley (R-Iowa) says the Department of Justice (DOJ) briefed federal prosecutors and FBI investigators on the contents of a scheme alleging that then-Vice President Joe Biden took a criminal bribe from a foreign national but left IRS investigators out of the loop on the allegations.

In an Oct. 23, 2020, meeting, Grassley alleged in a July 10 letter to U.S. Attorney David Weiss, FBI investigators and Assistant U.S. Attorney (AUSA) Leslie Wolf were made aware of criminal bribery allegations levied against Mr. Biden in an FD-1023 form, a form used by the FBI to record allegations of potential criminal activity (pdf).