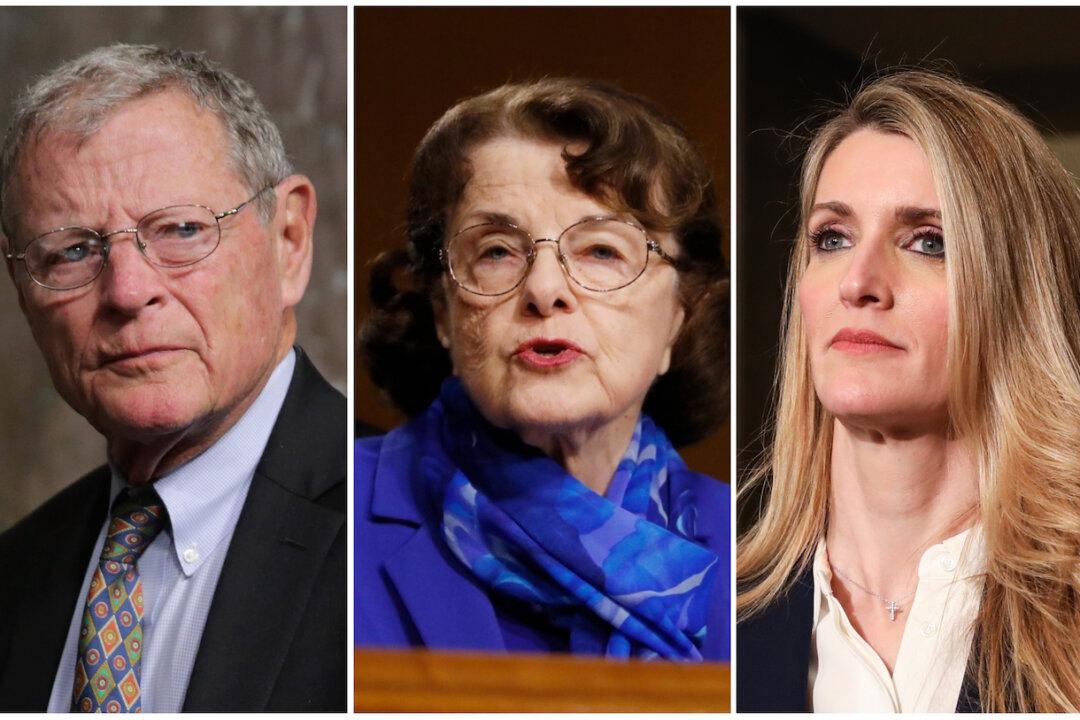

The Department of Justice (DOJ) has dropped investigations into stock trades made by Sens. Dianne Feinstein (D-Calif.), Kelly Loeffler (R-Ga.), and Jim Inhofe (R-Okla.) in the early weeks of the CCP virus pandemic, according to reports.

Feinstein, Loeffler, and Inhofe, who were heavily scrutinized for selling stocks around the time they were receiving closed-door briefings on the CCP (Chinese Communist Party) virus in January, were notified on May 26 that they are no longer under investigation by the DOJ, The Wall Street Journal first reported, citing unnamed people familiar with the matter.