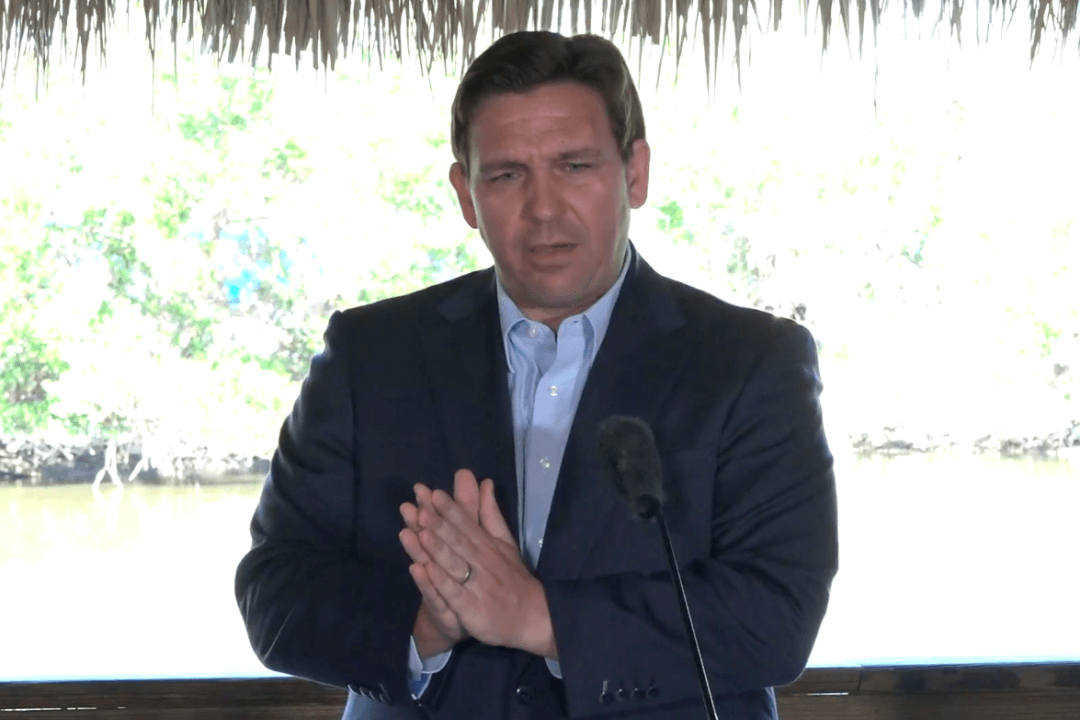

Florida Gov. Ron DeSantis called for a tightening of the state’s litigation process to make it tougher to file frivolous lawsuits, and to guard against unscrupulous “billboard lawyers.”

Speaking in Jacksonville on Feb. 14, DeSantis was joined by legislative leaders House Speaker Paul Renner and Senate Majority Leader Kathleen Passidomo who vowed to work to shape the legislation and get it passed.