A Chinese national has been sentenced to more than four years in prison over a scheme to fraudulently obtain $20 million in federal COVID-19 pandemic relief loans that were meant for distressed small businesses.

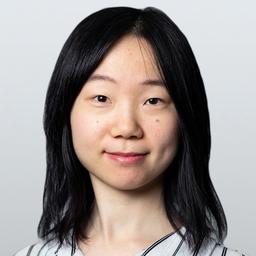

New York resident Muge Ma, 38, falsely claimed to have hundreds of employees at two phony companies he controlled—New York International Capital (NYIC) and Hurley Human Resources (Hurley)—to which he said he paid millions of dollars in wages monthly, according to federal prosecutors.