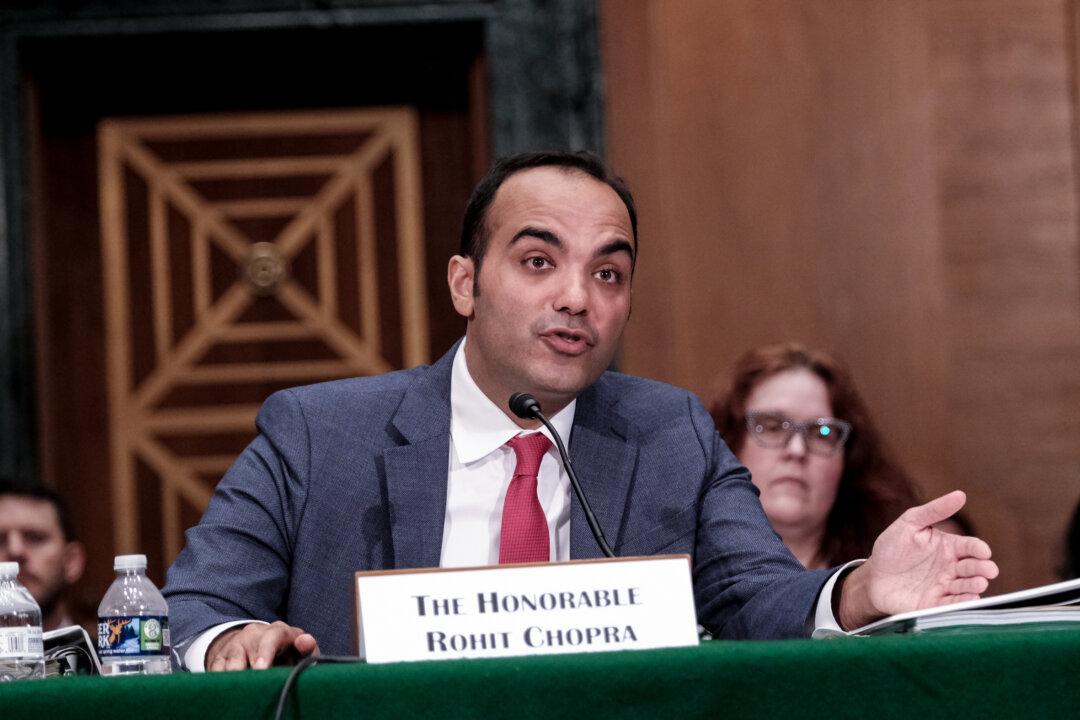

Asset managers that acquire an influential stake in banking institutions must be kept in check, according to Rohit Chopra, director of the Consumer Financial Protection Bureau (CFPB).

“Today, very large investment managers, like BlackRock and Vanguard, own significant stakes in commercial enterprises across the economy,” said Chopra in a Dec. 30 statement. “They also own stakes in insured banks,” he said, referring to banks whose deposits are insured by the Federal Deposit Insurance Corporation (FDIC).