With California facing a significant budget deficit due to corporate and personal income tax collections failing to meet expectations over the past year, a report released June 5 by the nonpartisan Legislative Analyst’s Office found that revenues collected in May were higher than anticipated.

California’s Tax Collections in May Far Exceeded Expectations

Analysts aren’t celebrating the revenue bump because they say it could simply be June payments showing up early.

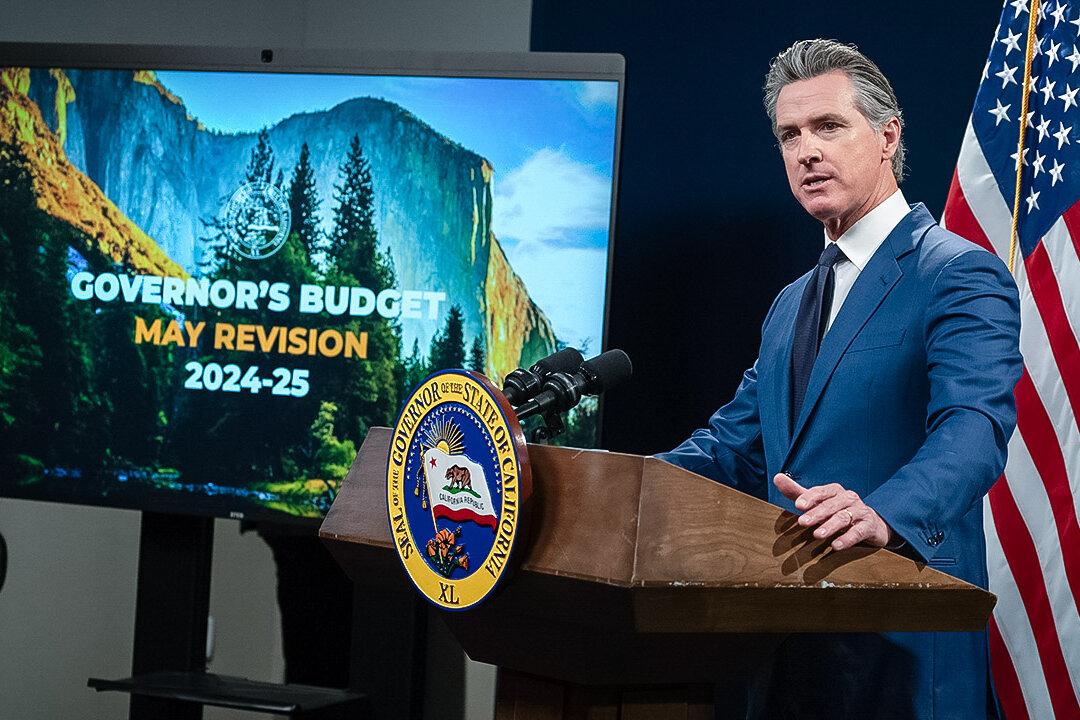

California Gov. Gavin Newsom announces the state’s revised budget in Sacramento on May 10, 2024. Office of California Gov. Gavin Newsom

Travis Gillmore is a White House reporter for The Epoch Times. He previously covered the California legislature and Gov. Gavin Newsom. Contact him at [email protected]

Author’s Selected Articles