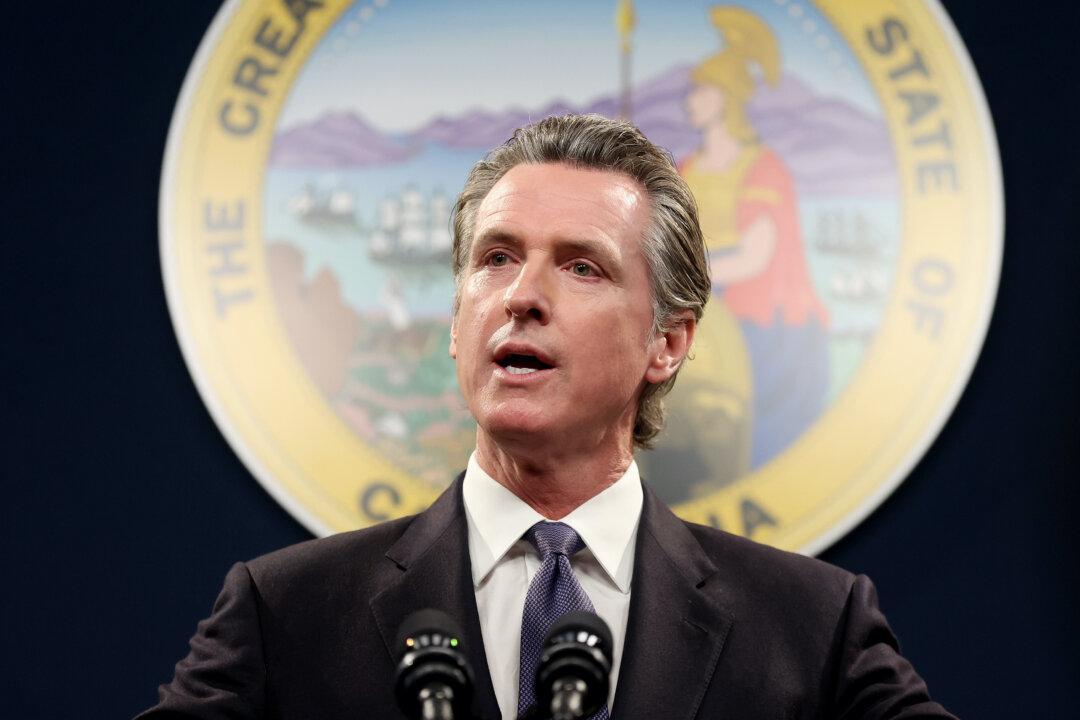

California lawmakers will hold a special public hearing Feb. 22 to consider Gov. Gavin Newsom’s plan to impose a windfall tax on oil companies.

The proposal would place mandatory caps on oil refinery profits and add industry regulations and oversight, according to the governor.