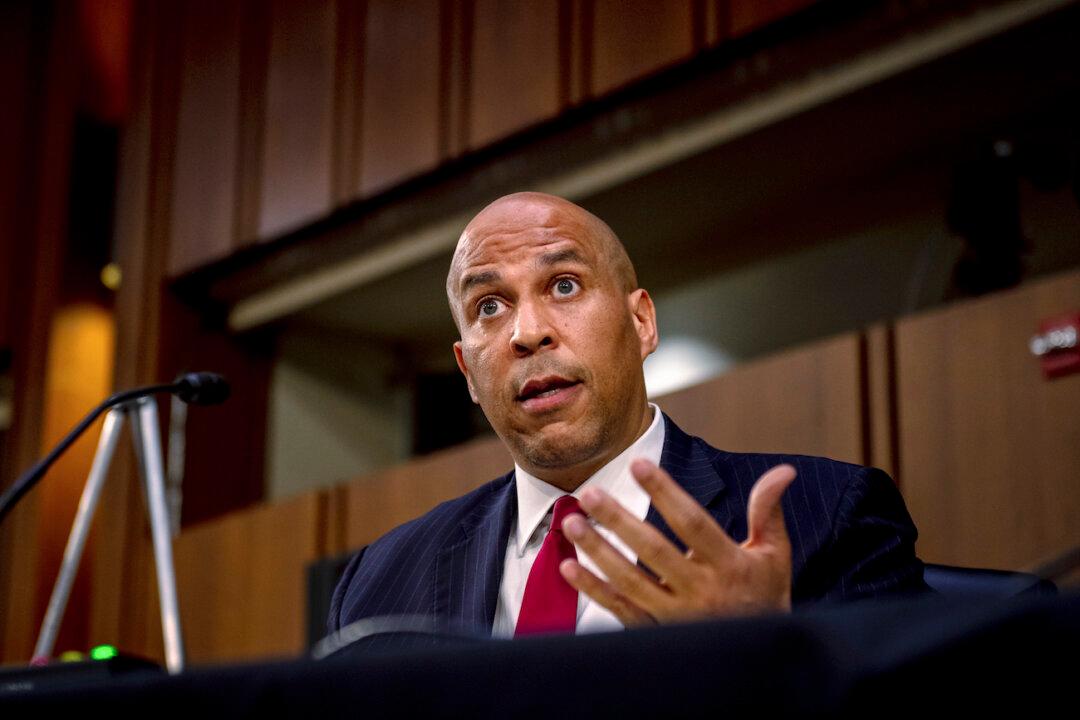

Sen. Cory Booker (D-N.J.) said he’s engaged in high-level discussions about making permanent the temporary expansion to the child tax credit brought about by the American Rescue Plan that President Joe Biden has signed into law.

Speaking at a press conference on March 12, Booker hailed the $1.9 trillion relief bill—which Republicans panned as wasteful and excessive—as “in your lifetime ... the biggest investment made in working Americans” and repeatedly touted it as a “massive, multi-billion dollar investment” in various priority areas, including American families, state and local governments, and unions.