WASHINGTON—Drug cartels, sex traffickers, and terrorists benefit because more personal information must be provided to obtain a library card than to create a company in America, and a bipartisan group of senators is determined to do something about the situation.

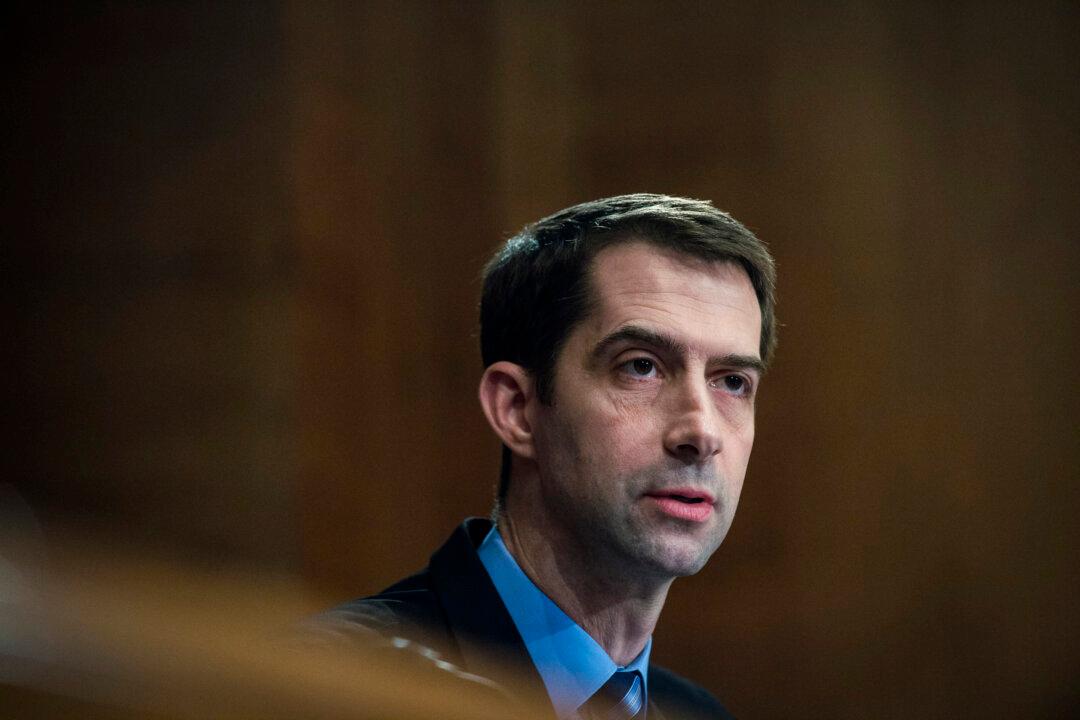

To that end, Sens. Mark Warner (D-Va.), Tom Cotton (R-Ark.), Doug Jones (D-Ala.) and Mike Rounds (R-S.D.) have introduced the “Improving Laundering Laws and Increasing Comprehensive Information Tracking of Criminal Activity in Shell Holdings Act” (ILLICIT CASH).