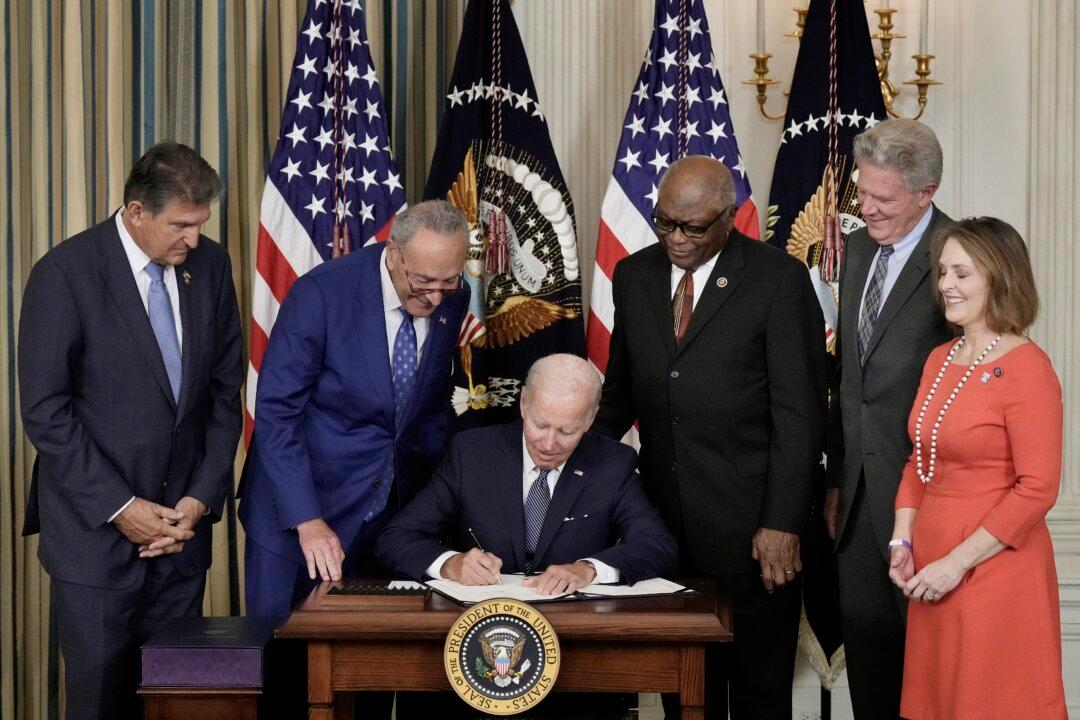

President Joe Biden’s student debt forgiveness program is set to billions of dollars in loans, but whether it’s fair to saddle others with these debts, and whether the Supreme Court will let them, is far from settled.

The Biden administration on Nov. 18 asked the U.S. Supreme Court to reinstate the program after a lower court blocked it.