President Joe Biden has reiterated his position that the child tax credit should be extended, but this time signaling openness to the possibility that he might support an extension beyond the additional four years for which his American Families Plan calls.

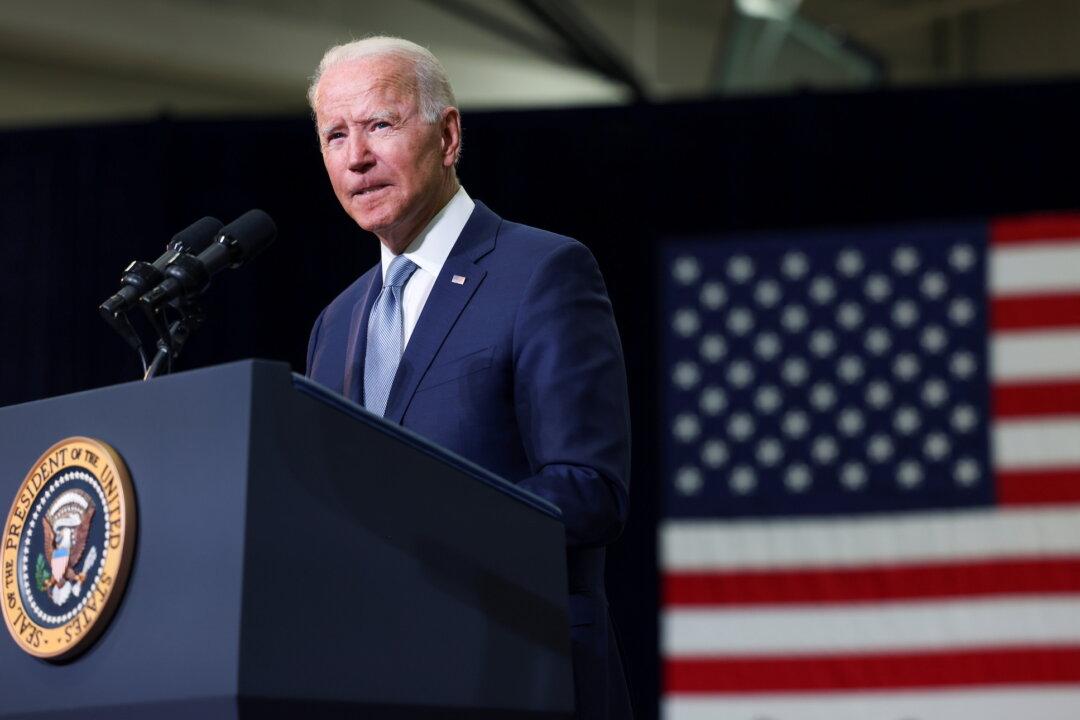

“Let’s extend the tax cut at least through 2025,” Biden said, speaking at McHenry County College in Crystal Lake, Illinois, near Chicago on July 7.