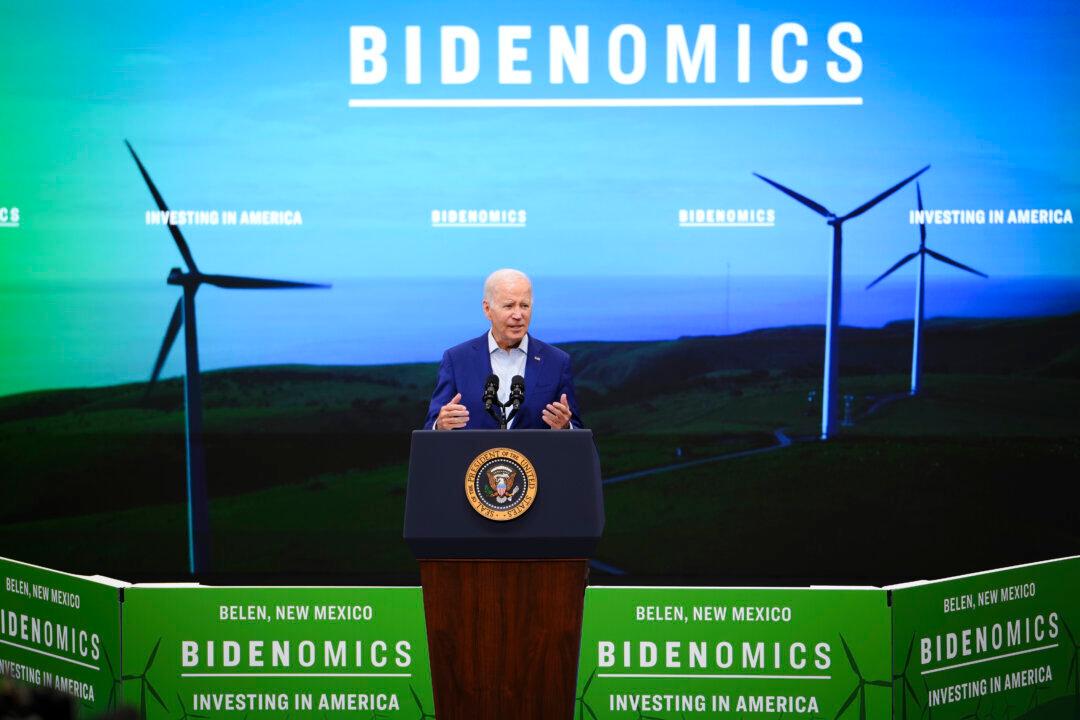

President Joe Biden is confident in the success of his “Bidenomics” economic strategy and the benefits it would offer middle-class Americans, yet the majority of voters are still unfamiliar with or skeptical of his economic vision.

While unemployment hovers around historically low levels, there has been a significant drop in inflation compared to last year, a point frequently underscored by President Biden.