President Joe Biden on July 7 reiterated his call to end tax breaks for fossil fuel companies, a policy proposal that would remove incentives for U.S. oil firms to boost production at a time when gas prices in the United States have soared to seven-year highs and are projected to continue their skyward climb.

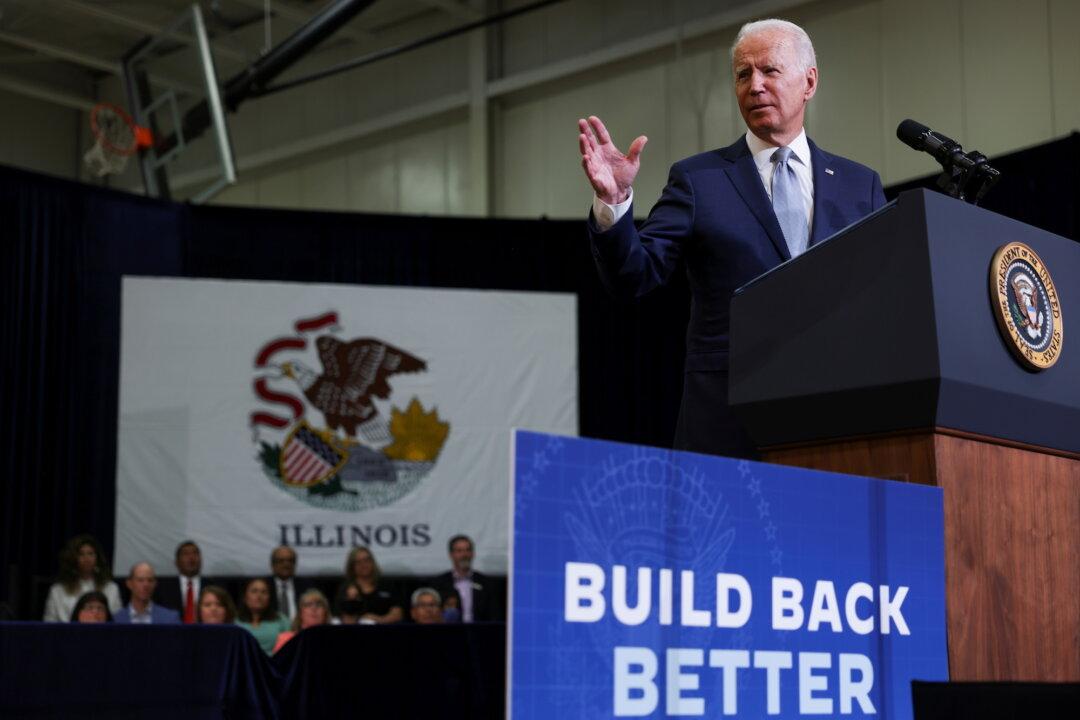

Speaking at McHenry County College in Crystal Lake, Illinois, near Chicago, Biden said: “If we end tax breaks for fossil fuels and make polluters pay to clean up the messes they have made, that would raise $90 billion.”