California lawmakers have identified about $73 billion in solutions to balance the state’s fiscal year 2024–2025 budget in the past months, according to a report published by the nonpartisan Legislative Analyst’s Office on May 17.

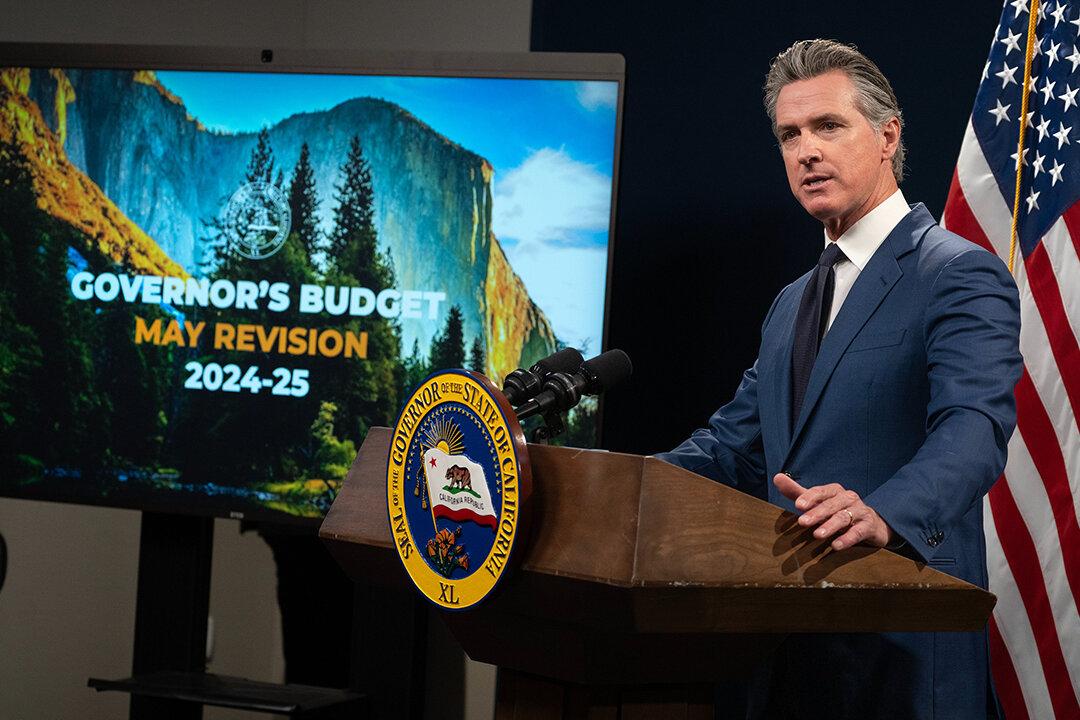

According to the report, Gov. Gavin Newsom proposed about $55 billion in fixes in his budget revision released on May 10, and the Legislature approved an early action plan solving $17.3 billion in a measure that was signed into law on April 15.