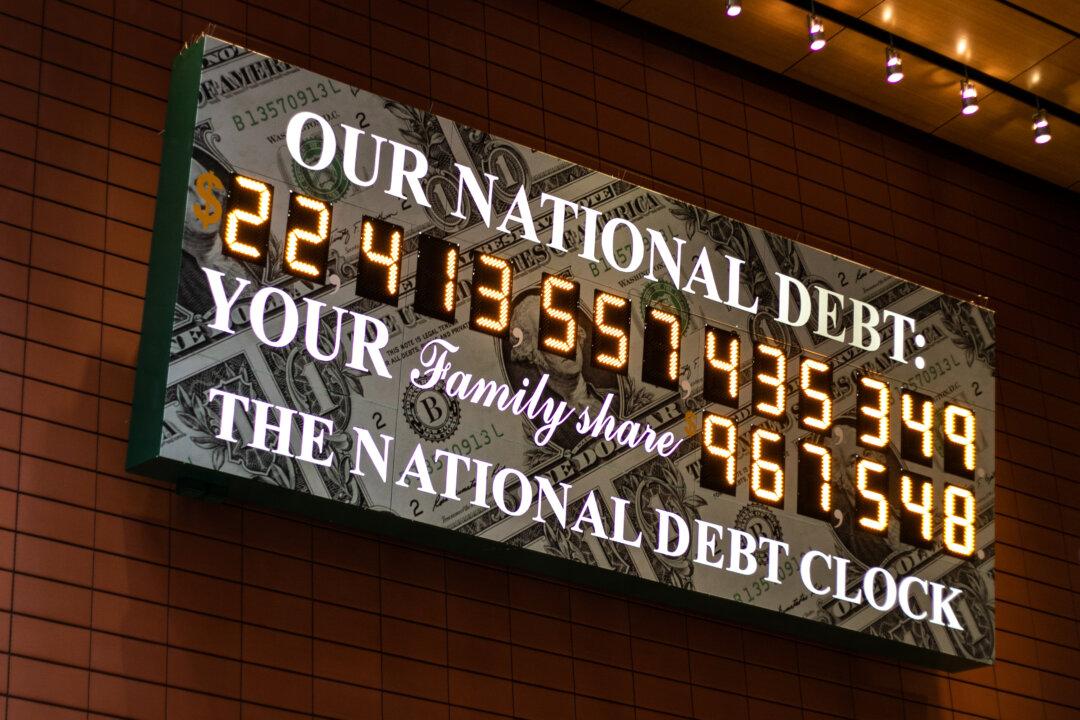

The United States will reach its statutory debt ceiling sometime between July and September unless Congress raises it. If the ceiling is reached, what happens next?

The answer depends on which economist you ask.

The United States will reach its statutory debt ceiling sometime between July and September unless Congress raises it. If the ceiling is reached, what happens next?

The answer depends on which economist you ask.